The automotive industry is entering a Marvel’s “Jarvis moment,” where the most meaningful change is not what drivers can see, but what they experience: software that makes the vehicle smarter and personalised throughout its life.

Four forces are shaping that shift. Two sit largely outside the industry’s control. The first is trade policy volatility, including renewed tariff risk, which adds friction across supply chains and manufacturing footprints and can change planning assumptions quickly. The second is the pace of competitive disruption from players willing to redefine development and consumption models, backed by deep investment and a higher tolerance for fast iteration.

The other two forces are levers automakers can influence. One is decreasing spend, with budgets tightening year after year and forcing sharper choices on where investment creates value. The other is softwarization: the move to software-led vehicles, software-led operations and software-led customer relationships.

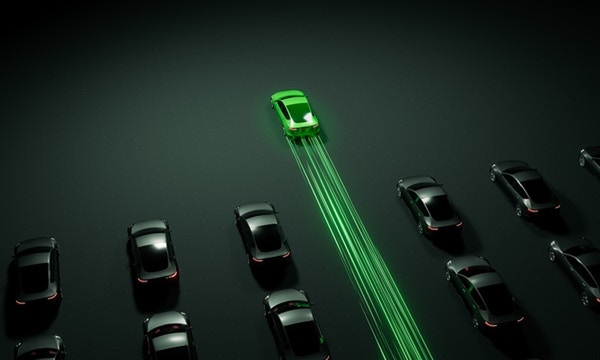

Together, these pressures are shifting the industry from a product world, where capabilities are fixed at the point of sale, to a demand and personalisation world, where functionality evolves and monetisation extends across the lifecycle.

The six trends below show how this shift will play out in practice and where automotive leaders will need to focus in 2026.

Trend 1: Cars keep getting better, but not in model years

In 2026, standout brands will not be the ones boasting the longest feature list at launch. They will be the ones whose vehicles keep improving after purchase, regularly and reliably. Updates will become part of normal ownership, and the gains will extend beyond infotainment into everyday behaviour, such as efficiency, comfort, diagnostics and refinement.

This becomes realistic because vehicles are finally being designed in ways that make updates safer to deliver at scale. Until now, many cars were built from a patchwork of systems that did not connect cleanly, which made change risky and slow. In 2026, the logic flips: continuous improvement becomes a baseline expectation and staying current for the duration of use becomes a measure of quality.

Trend 2: AI plumbing finally lands and starts proving it works

In 2026, the difference will not be who has the flashiest AI demo. It will be who can prove that driver-assistance gets safer and smoother over time. The strongest approaches will treat these capabilities as living systems: monitored continuously, improved using real-world learnings, tested through “what-if” scenarios, then upgraded through controlled rollouts.

This improvement loop becomes real because the tooling and computing needed to run it at scale are finally mature enough, and because regulators, insurers, fleets and customers increasingly demand evidence, not promises. It has not scaled widely because data has often been inconsistent and proving safety across rare and unpredictable road situations is genuinely hard. In 2026, the winners will be those who industrialize the cycle from data to validation to deployment, rather than treating AI as a one-time feature release.

Trend 3: One thread, one truth, invisibly visible

By 2026, carmakers will be expected to answer simple questions quickly: What changed? Which vehicles does it affect? Who supplied the part? What testing proves it is safe? That capability depends on an invisible thread that joins what was planned, what was built, what was shipped and what is happening in the field.

When something goes wrong, this thread enables faster root-cause analysis and clearer decisions on whether the right response is a software fix, a targeted service action or a recall. This accelerates in 2026 because software update expectations, cybersecurity requirements and governance scrutiny are tightening. It has not been common because many enterprise systems do not connect cleanly and suppliers do not always share data consistently. In a software-defined world, linked traceability becomes a safety and economics requirement.

Trend 4: EVs compete on charging transparency and value, not just range

In 2026, EV buyers will care less about the biggest range number on a brochure and more about how painless charging feels in real life. The best EV experiences will make charging more predictable: warming the battery before arrival, charging quickly when it matters and guiding drivers to chargers that are available and working. Access will also get smoother, with less app juggling and more seamless charging capabilities.

The competitive edge shifts towards confidence and transparency. Clearer information about battery health will matter for resale value and for mainstream adoption. EVs will increasingly be sold as energy products too, including home backup power and smart charging that reduces costs. This change happens because range is becoming good enough for most drivers, while charging networks and payment systems are improving. Progress has been slower because charging has been fragmented and unreliable and many brands have avoided standardised battery health transparency.

Trend 5: Smart mobility finally feels joined up

In 2026, smart mobility grows because it becomes simple, not because there are more apps. People will not adopt at scale if they need multiple logins, multiple payment methods and different rules in every area. Momentum will come from services working together: tap-to-pay across modes, shared sign-ins, better real-time information and more consistent service standards shaped by cities.

This shift is happening because public bodies are pushing for smoother, more efficient transport systems and operators want growth without massive new infrastructure investment. Joining up services is one of the fastest wins available. It has not scaled because operators have protected their own apps and customer relationships and governance has lagged on enablers like curb-space rules, data sharing and safety standards. In 2026, interoperability becomes the expectation, because fragmentation is a direct barrier to demand.

Trend 6: Reliability and trust replace horsepower as the bragging right

By 2026, a real differentiator will not be who has the cleverest software or the most advanced AI. It will be who people trust. When a vehicle updates itself and makes more decisions on the driver’s behalf, confidence becomes everything. If an update unexpectedly changes behaviour, or assistance features act inconsistently, trust is lost quickly and is hard to regain.

The strongest brands will treat trust like a product capability: clear communication about what the vehicle can and cannot do, careful update rollouts that catch problems early and explanations in plain language. This matters more in 2026 because more vehicles are always-on and always-updating, and scrutiny from regulators, insurers, fleets and customers is rising. The industry is moving toward a world where the product must be run like a live service for years and reliability becomes the foundation of loyalty.

What this means for 2026

In 2026, automotive leaders will be those who can run vehicles and services as living systems. That means delivering improvement through software, proving safety and performance over time and removing friction from ownership, especially around charging, transparency and usability.

The winners will also be pragmatic. External volatility, including tariff risk, will keep testing supply chains and footprints, while disruption continues to compress timelines. With budgets tightening, the controllable levers matter most: disciplined investment, softwarization done at scale and the operational foundations that make change safe, auditable and understandable.

Ultimately, reliability becomes the differentiator people talk about. Not horsepower, not novelty, but confidence that the vehicle will behave as expected, improve responsibly and communicate clearly. Trust will be the currency that turns technology into adoption and adoption into loyalty.

Artikel anhören

Artikel anhören