Key takeaways:

- Automotive value is shifting from vehicle volume to data-driven intelligence and software capabilities

- Software-defined vehicles function as continuous data engines across the vehicle lifecycle

- Centralized data platforms turn raw signals into actionable, monetizable intelligence

- Trust, privacy and governance are foundational to sustainable data monetization

- Recurring, service-based revenue models now outperform one-time vehicle sales

What defines the new frontier of automotive data monetization

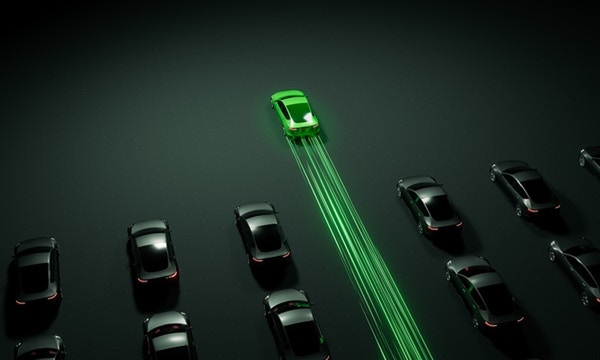

The definition of automotive value has fundamentally shifted. Success is no longer tied to production volume but to the intelligence embedded within every vehicle. Today’s software-defined vehicles (SDVs) operate as high-velocity data engines, capturing, transmitting and refining insights at a scale that represents a dramatic evolution from a decade ago.

Every pedal input, reroute instruction or charge event generates high-frequency data points. When structured and analyzed, these signals unlock powerful opportunities in performance optimization, customer experience and new revenue models. But there’s a catch: data becomes valuable only when it is governed, managed and monetized responsibly.

OEMs that establish a centralized data backbone can integrate, secure and contextualize information at the heart of the entire connected vehicle ecosystem, which will be able to convert raw data into continuous, compounding value.

How the data value chain works in software-defined vehicles

Data in an SDV doesn’t move in silos. It flows through a tightly connected value chain made up of sources, types and transformation processes.

- Data sources span OEMs, Tier-1 suppliers, infrastructure players and third-party partners like insurers and navigation providers. Each contributes to an integrated ecosystem where data is generated, consumed or enriched

- Data types encompass motion and performance metrics, component diagnostics, parking behavior insights, energy usage patterns and more. Together, these elements create a comprehensive, unified view of vehicle health and driver interaction

Processing flow outlines the journey from raw data to actionable intelligence:

a. Collection: Sensors and ECUs capture real-time signals, such as driving behavior, component conditions and environmental data, creating a constant stream of vehicle intelligence

b. Storage: Cloud-native platforms consolidate this information into a context-rich environment, maintaining integrity, ensuring synchronization and enabling instant insights for cross-functional teams

c. Analytics: AI-driven models interpret the data to detect patterns, predict failures and optimize features. AI agents further curate, standardize and structure data in real time, while AI-assisted search and insight generation accelerate downstream monetization

d. Privacy and access control: Governance frameworks safeguard consent, enforce integrity and establish trust, turning compliance into strategic differentiation

A well-designed data value chain doesn’t just record information; it transforms it into intelligence. That’s where the true SDV value is created.

How to build an effective data monetization architecture

Converting automotive data into measurable business impact requires a monetization architecture built on scalable technology and uncompromising trust.

- Edge-cloud integration lies at the core of SDV monetization. The edge powers real-time decisions for ADAS, safety systems and dynamic performance tuning. The cloud delivers large-scale analytics and collective learning. Together, they enable a continuous optimization loop across the fleet

- Governance, compliance and privacy form the operational backbone. Without robust, transparent structures, even the most advanced digital platforms lose credibility. Leading OEMs embed privacy into the architecture, ensuring every touchpoint of data capture, storage and sharing aligns with global and regional regulatory expectations. Consent-first models strengthen user trust and provide a stable foundation for long-term monetization

- APIs and secure data-sharing protocols define how insights flow across the SDV ecosystem. They formalize access rights, ensure traceability and maintain OEM control while enabling co-innovation with partners

- Data marketplaces are emerging as a critical commercial layer. These platforms facilitate the exchange of privacy-preserved operational insights with insurers, logistics providers, city planners and mobility partners. The outcome is smarter decisions, higher efficiency and scalable new revenue models

The global market for connected car solutions, which underpins many of these use cases, is projected to grow up to $148.6 billion by 2030, illustrating the scale of opportunity around data-driven services and ecosystems. What is exchanged is not raw data, but actionable intelligence that powers real-world decisions, operational efficiencies and new business models.

What key pathways enable automotive data monetization

In SDVs, monetization isn’t about selling data — it’s about delivering service-driven, value-centric experiences that can scale and evolve over time.

- On-demand features: Software unlocks flexible value. Drivers activate features, from ADAS modes to cabin comforts via subscriptions, shifting revenue from one-time sales to recurring streams

- Usage-based insurance: Telematics and driving analytics enable personalized premiums, safer driver incentives and deeper cross-industry partnerships

- In-vehicle commerce: Fuel payments, parking access, EV charging and quick-service integrations turn everyday journeys into seamless transaction experiences

- Predictive maintenance: Real-time vehicle monitoring reduces downtime, increases reliability and expands service-based revenue potential

- Data licensing: Aggregated mobility intelligence supports better urban planning, traffic optimization, fleet operations and real-time navigation enhancements

- EV charging and energy optimization: Smart charging insights support grid load balancing, energy resale opportunities and collaborations with renewable energy ecosystems

- Anonymized data insights: When responsibly handled, de-identified data becomes a high-value asset powering decisions in insurance, fleet management, logistics and energy sectors

Collectively, these pathways create a flywheel where every new connected vehicle strengthens the OEM’s digital revenue base.

How governance and trust shape a sustainable data strategy

Data privacy isn’t just a regulatory mandate; it’s a strategic differentiator. Customers who trust an OEM with their data willingly share more meaningful information, fueling better insights and stronger monetization outcomes.

Industry leaders embrace privacy by design, collect only essential data and give users transparent control. While regulations like GDPR and CCPA set the baseline, forward-thinking OEMs simplify consent, communicate value clearly and automate compliance at the system level.

How automakers shift from one-time sales to recurring revenue models

The shift from mechanical to digital value is fundamentally reshaping revenue structures. Traditional automotive economics, rooted in capital expenditure from vehicle sales, are being overtaken by recurring models built on software, intelligence and services.

BCG estimates that software-defined vehicles could create more than $650 billion in additional value potential for the auto industry by 2030, accounting for 15-20% of total automotive value. This transition unlocks high-margin, scalable digital ecosystems that grow with every new connected vehicle. OEM competitiveness will increasingly hinge not just on engineering excellence but on digital service sophistication, from Over-the-Air (OTA) upgrades to predictive intelligence to mobility platforms.

The automotive data economy is projected to grow, underscoring the urgency for OEMs to adopt data-first business strategies. Those who delay today risk becoming commodity hardware providers in a market dominated by intelligence-native players.

How software-defined vehicle data will power the next automotive digital economy

SDVs are evolving into self-sustaining data economies. Each vehicle continuously generates insights, refines intelligence and creates business value.

OEMs that excel across data management, technical infrastructure, governance and ecosystem collaboration will define the next era of automotive leadership. Success now hinges on building platforms that handle massive data volumes, applying privacy as a trust multiplier, forging partnerships that unlock new value streams and adopting digital-first revenue models.

The question for automotive leaders isn’t whether to pursue data monetization, but whether they can build the capabilities fast enough to compete with technology disruptors already reshaping what it means to be an automotive company.

FAQs

What is automotive data monetization?

Automotive data monetization is the process of transforming vehicle-generated data into measurable business value through digital services, insights and partnerships. It focuses on delivering intelligence-driven outcomes rather than selling raw data, enabling scalable and recurring revenue streams.

How do software-defined vehicles (SDVs) generate and use vehicle data?

SDVs collect high-frequency data from sensors, ECUs and software systems covering driving behavior, performance and environment. This data is processed through edge and cloud platforms to enable real-time decisions, predictive insights, feature optimization and continuous service innovation.

What strategies help automakers monetize connected vehicle data effectively?

Effective strategies include building centralized data platforms, embedding privacy by design, leveraging edge-cloud integration, enabling secure APIs and partnerships, and focusing on service-led use cases such as subscriptions, predictive maintenance and mobility intelligence.

How is the automotive data monetization market evolving?

The market is shifting from experimental pilots to large-scale ecosystems driven by software, AI and connectivity. Growth is fueled by recurring digital services, cross-industry data partnerships and increasing demand for real-time, intelligence-based decision-making across mobility, insurance and energy sectors.

What factors enable a scalable and trusted data monetization framework?

Key enablers include strong data governance, consent-first privacy models, secure access controls, regulatory compliance, cloud-native scalability and transparent value exchange. Trust transforms data from a compliance risk into a competitive advantage and accelerates long-term monetization.

How can OEMs turn SDV data into recurring revenue opportunities?

OEMs can monetize SDV data through subscriptions, usage-based services, in-vehicle commerce, predictive maintenance, energy optimization and anonymized data insights. These models create compounding value, where every connected vehicle strengthens the digital revenue ecosystem over time.

記事を聴く

記事を聴く