Introduction

In the high-stakes world of investment management and broker-dealer firms, the front, middle and back offices have long functioned as isolated domains. Each serves its own purpose, relies on separate systems and often communicates via tickets and reconciliations. But in today’s fast-paced markets, this siloed model is quickly becoming obsolete.

Enter Agentic AI — intelligent, autonomous systems capable of reasoning, learning and executing cross-functional workflows without human micromanagement. These AI agents are transforming how firms operate, enabling real-time integration from front to back.

In this blog, we explore why integration is essential, how the landscape is shifting and how Agentic AI can drive true end-to-end investment operations.

Why investment management integration matters more than ever

- Market complexity has exploded: Modern trades span asset classes, jurisdictions and regulatory regimes. Silos create latency, blind spots and operational and financial risk.

- Clients expect seamless experiences: More than ever, today’s clients want instant access to performance, personalized insights and real-time execution and reporting. Clients will not be concerned about the internal process gaps caused by internal handoffs.

- Margins are being squeezed: With shrinking fees and rising compliance costs, inefficiencies and duplicated efforts must be eliminated.

What is agentic AI and how it’s different from GenAI?

Think of deploying a digital assistant within a system GenAI works like a highly skilled writer or analyst which can handle tasks such as "Summarize today’s trades" by producing a detailed report. On the other hand, Agentic AI (AI Agents) functions more like a proactive virtual colleague. For example, If Agent notices trade issues, it investigates them, performs necessary checks, alerts relevant stakeholders and even proposes actionable next steps, all without requiring a prompt.

Unlike traditional AI that answers queries or performs narrow tasks, Agentic AI goes beyond automation, act with intent. It involves autonomous software agents that can:

- Make decisions with context awareness

- Orchestrate multi-system workflows

- Learn from feedback and adapt

Agentic AI thrives in a collaborative intelligence model—where human expertise and machine autonomy work in tandem to deliver faster, smarter outcomes.

How Agentic AI transforms investment management ops

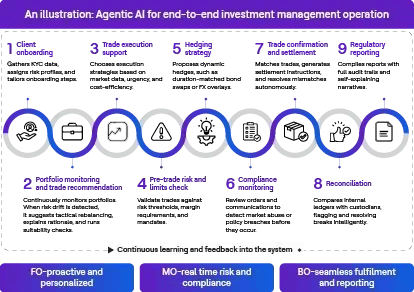

Here’s a key transformation themes how agentic AI can be leveraged to integrate front-to-back office operations for an investment management firm.

Cross-domain orchestration

AI agents seamlessly connect and bridge gaps across silos such as trading, risk management, compliance and operations, ensuring end-to-end workflow coordination. This eliminates handoffs, reduces delays and resolves misalignments.

Unified data context across F-M-B offices

Agents share and process real-time data across all operational layers. For example: A front-office trade recommendation immediately considers middle-office risk thresholds and back-office operational constraints.

Context-aware decision-making

Agents leverage real-time market data, client behavior insights, internal compliance protocols and regulatory frameworks to make proactive informed and actionable decisions throughout the value chain.

Autonomous workflow execution

From initial trade idea generation to post-trade settlement, agents autonomously initiate, execute and monitor tasks without giving prompts and with minimal human intervention.

- Initiate tasks (e.g., rebalancing due to risk drift).

- Coordinate tasks across systems (e.g., trigger settlement confirmation after trade execution).

- Complete workflows end-to-end (e.g., from Trade opportunity to settlement to regulatory reporting).

Shared intelligence for decision support

Where insights from one process will be leveraged for better decision making for other Processes in the workflow. Examples: If a client trade might breach a regional limit or trigger a margin call, the AI warns both the sales team and risk manager proactively. Similarity back office alerts front office about trade settlement risks before client impact.

Continuous learning and adaptation

AI agents evolve by learning from every interaction, whether it’s client preferences, market changes, system alerts, or regulatory updates. This continuous learning enhances their logic and decision-making abilities over time.

By learning from both structured data and human feedback, agents not only evolve but also amplify human decision-making and turning every interaction into a learning opportunity.

Below is the illustration of how an integrated investment management lifecycle would be managed by Agentic AI:

What’s payoff?

| Operational efficiency |

|

| Better risk control |

|

| Enhanced client experience |

|

| Scalability with governance |

|

How to start building integrated AI-driven Ops

Every firm exhibits varying levels of process maturity with respect to automation and AI initiatives. To maximize the potential of agentic AI capabilities, it is essential to approach this as a unified program rather than addressing use cases in isolation. Firms need to build modular architecture based on multi agent system, LLM based reasoning engine and event driven orchestration platform. Below are the recommended steps to follow for achieving the best outcomes.

- Map investment management trade lifecycle: Layout end to end business process and identify where silos and manual interventions occur. Highlight high impact areas for AI agents deployment prioritization.

- Data unification: Develop a data access strategy across F-M-B office for data standardization, accessible (e.g. APIs/data fabric), event driven updates for data synchronization. This is a critical preparatory step before deploying AI agents, aimed at creating a single, coherent, and real-time view of data across systems.

- System integration: This can be an ongoing process and priority should be given for system part of the high impact uses case for deploying AI agents

- Deploy AI agents first in high-impact areas: This could differ for each firm based on internal assessment for higher ROI. Some potential areas start with are onboarding, middle office operation and reconciliation

- Create a cross-system agent layer: Allow agents to interface across systems such as CRM, OMS, risk engines and compliance systems.

- Embed explainability and controls: Ensure every decision is logged and justifiable for audits and regulators.

- Measure and iterate: Use KPIs like settlement speed, exception rate and operating costs to measure the performance and continuous improvements.

The road ahead

We are at a turning point. Firms that treat AI as a patchwork of use cases will miss the opportunity. Those that use Agentic AI to reimagine operations, from first client interaction to regulatory filing, will gain unmatched speed, accuracy and agility.

The future of investment management isn’t just digital—it’s autonomous, adaptive and agent-driven. The firms that embrace this shift will lead the next era of financial innovation.