Generative AI (GenAI) is spearheading a tech revolution. In this first blog in a series of two, I’ll provide an overview of GenAI business trends, dominant GenAI products, their market share and a comparative product analysis.

GenAI business trends

According to Bloomberg Intelligence (BI), GenAI is primed to make an increasingly strong impact on enterprises over the next five years. BI also predicts that GenAI will:

- Surge to 42% CAGR over the next decade

- Account for 12% of total technology spend and 25-30% of total tech revenue by 2032

- See escalating demand anticipated to inject a substantial $280 billion into new software revenue

Also weighing in on GenAI’s impact, Gartner predicts that:

- By 2024, 40% of enterprise applications will have embedded conversational AI, up from less than 5% in 2020

- By 2025, 30% of enterprises will implement an AI-augmented development and testing strategy, up from 5% in 2021

- By 2026, generative design AI will automate 60% of the design effort for new websites and mobile apps

- By 2026, over 100 million people will engage robot colleagues to contribute to their work

- By 2027, nearly 15% of new applications will be automatically generated by AI without a human in the loop, up from 0% today

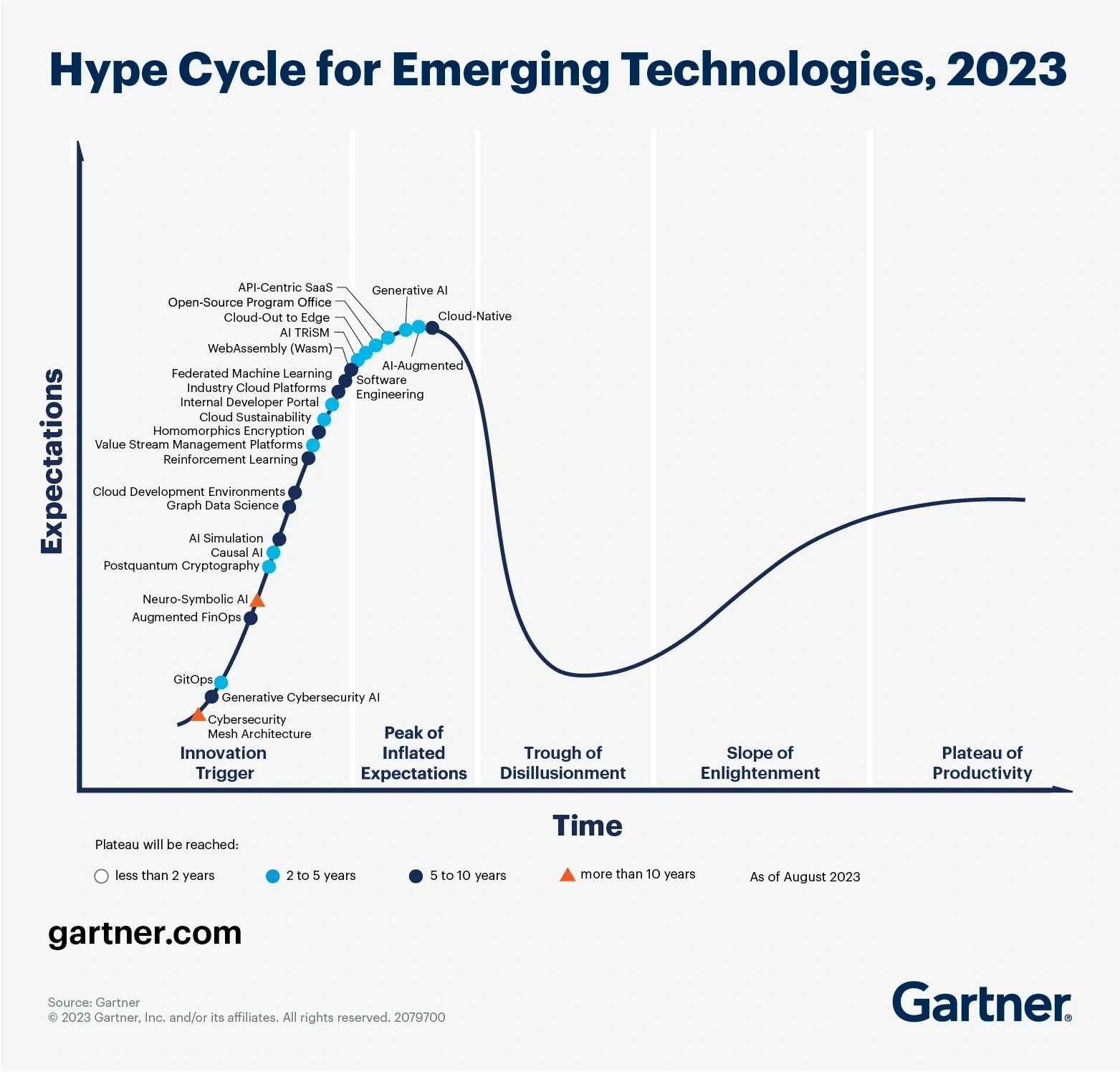

GenAI is maturing faster in some industries than others. As shown in the figure below, Gartner says that GenAI is currently at a peak of inflated expectations in its hype cycle for emerging technologies.

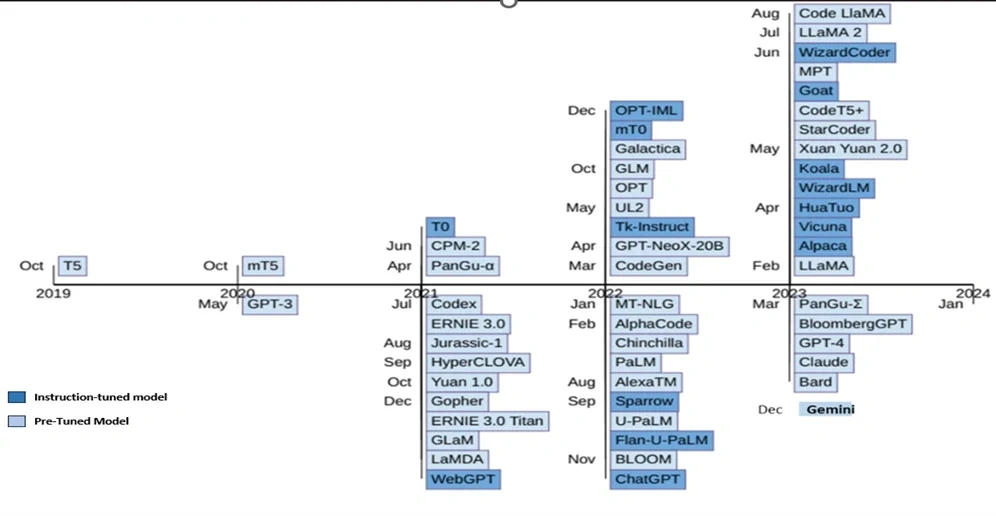

The future of GenAI beckons with limitless possibilities. Valuates Reports says that the market for large language models (LLMs), which comprehend and generate human language text by analyzing massive language data sets, was valued at $10.5 billion in 2022 and is anticipated to reach $40.8 billion by 2029, witnessing a CAGR of 21.4% from 2023 through 2029. The figure below showcases the evolution of and increasing competition in the LLM market.

Dominant AI products

In recent years, AI has evolved significantly, with several prominent products leading the change. The AI giants — OpenAI, Gemini (formerly Bard) and LLaMA — have carved out a market niche for themselves with unique features and applications.

Here’s more detail on the dominant AI products:

OpenAI’s GPT-3.5, released in 2022, stands as one of the largest language models, with an incredible 175 billion parameters. Its language understanding capabilities enable it to generate human-like text and respond contextually to prompts. OpenAI's GPT-4 has emerged as their most advanced language model, with a staggering 1 trillion parameters, offering safer and more effective responses. This cutting-edge, multimodal system accepts both text and image inputs and generates text outputs, showcasing human-level performance on an array of professional and academic benchmarks. GPT-4 is more advanced and less prone to errors and hallucinations than GPT-3.5, but it also requires more computing power and costs more to run.

Gemini focuses on computer vision and image processing; its algorithms excel in tasks like object detection and facial recognition. Its ImageNet accuracy surpasses 90%, making it a go-to choice for visual intelligence applications. This is a new AI framework that Google offers. The market adoption is yet to be determined.

Meta’s LLaMA specializes in machine learning for predictive analytics. Its algorithms are renowned for accurate predictions, and it has gained traction in industries such as finance and healthcare for decision-making support.

Rabbit AI – This is a newer version of AI emphasizing LAM (Large Action Model) rather than LLM. LAM is an advanced AI system enabled by neuro-symbolic programming that performs human-like tasks in digital environments. Using neural networks and symbolic reasoning, LAMs interpret and execute complex commands in applications, like web navigation or online transactions, by directly modeling and understanding the logic and structure of these interfaces. Still in the early stages of development, a practical example of LAMs is the rabbit r1 device.

Market share

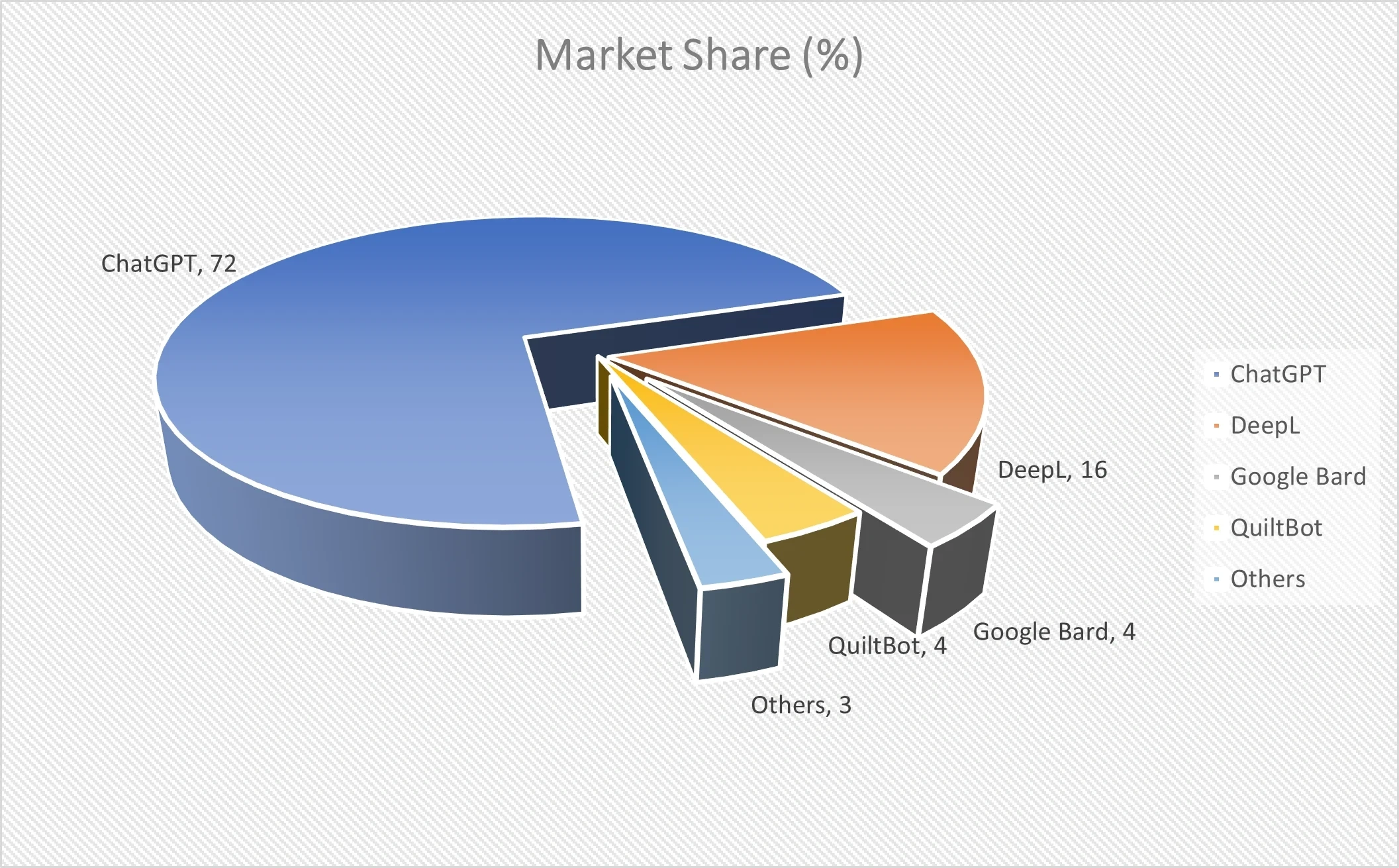

As of the latest market analysis by Statista Market Insight in Nov, 2023, OpenAI leads with a remarkable 72% market share, reflecting the widespread adoption of its language models. The rest of the players currently have minimal market acceptance.

Source - Statista Market Insight

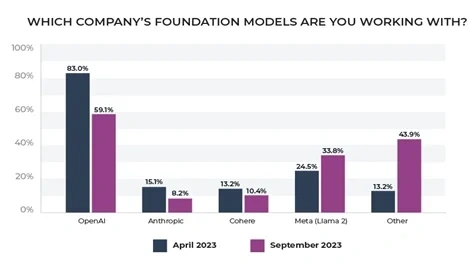

OpenAI's dominance is further emphasized by its strategic collaborations with major tech corporations. According a survey by Arize AI (see below figure), OpenAI dominates, with 59.1% of technical teams relying on the company’s LLMs. However, Meta’s LLaMA 2 with a 33.8% and other alternatives with 43.9% are becoming more popular.

In the “Other” category, Google PaLM 2 leads in adoption (20.7% of those surveyed), followed by Databricks (Dolly) at 14.9%, MosaicML at 5.6% and other minor player with 2.7%.

Source - Survey: Large Language Model Adoption Reaches Tipping Point - Arize AI

Comparative analysis

The table below shows an in-depth comparison of several features of the dominant AI products.

| Feature | GPT-4 | Gemini | LLaMA 2 |

| Parameter (number of parameters used for training) | 1.7 trillion |

Nano 1 – 1.8 billion Nano 2 – 3.25 billion Pro – 600 billion Ultra - 1.56 trillion Source- You Can Explore the New Gemini Large Language Model Even if You're Not a Data Scientist -- Pure AI |

70B |

| Architecture | Transformer-based | Transformer-based with multimodal extensions | Transformer-based with PaLM-like structure |

| Context window size | 32,768 tokens |

32,000 tokens Pro – up to 1 million |

4,096 tokens |

| Strengths |

|

|

|

| Weaknesses |

|

|

|

| Availability |

|

|

|

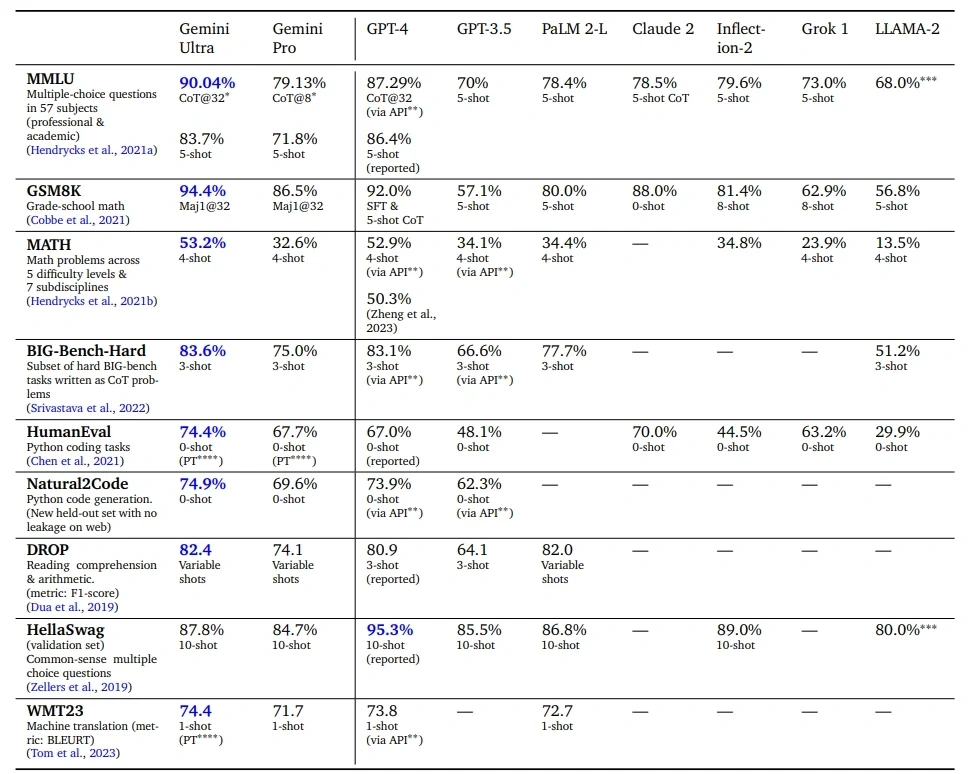

Comparison published by Google during the launch event of Gemini.

In recent evaluations across multiple benchmarks, the Gemini series, notably the Ultra model, has demonstrated exceptional performance, surpassing even the esteemed GPT-4. Specifically, the Gemini Ultra has showcased superior capabilities across various metrics, including Multitask Language Understanding (MMLU), Big-Bench Hard and DROP. For instance, in the MMLU benchmark, the Gemini Ultra achieved an impressive score of 90.04%, outpacing GPT-4's performance of 87.29%. Furthermore, it exhibited superior performance in both Big Bench Hard and DROP benchmarks, surpassing GPT-4 by margins of 0.5% and 1.5%, respectively. These results underscore Gemini's position at the forefront of cutting-edge language understanding technology.

The table below shows an in-depth comparison of the performance of several AI products against Gemini, on multiple benchmarks.

Source: Google Gemini Technical Report

Conclusion

As we navigate the dynamic landscape of GenAI, it's clear that innovative products are shaping the future of various industries. Market share data underscores the growing influence of these solutions, highlighting their transformative impact. Through careful analysis, it's apparent that each GenAI product offers distinct strengths tailored to diverse business needs. As businesses increasingly integrate AI-driven solutions, understanding these nuances becomes paramount for maintaining competitiveness and driving growth.

In the next blog in this series, we'll delve into the complex realm of AI, exploring the challenges, the dark side of AI use and potential abuse, ethical considerations and strategies for responsible adoption. Join me as we uncover the intricacies of the GenAI revolution and prepare for the opportunities and pitfalls that lie ahead.