Latest Content

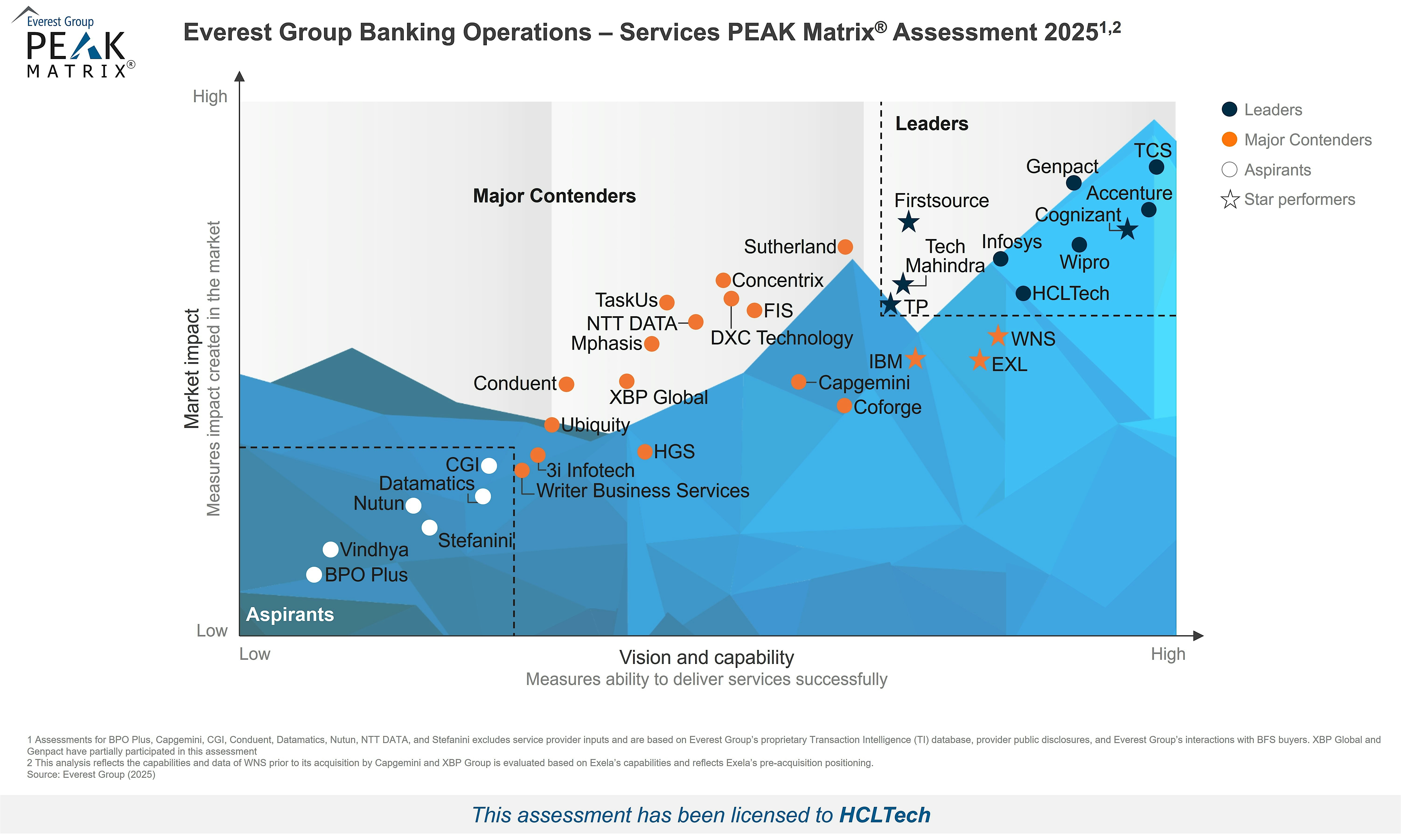

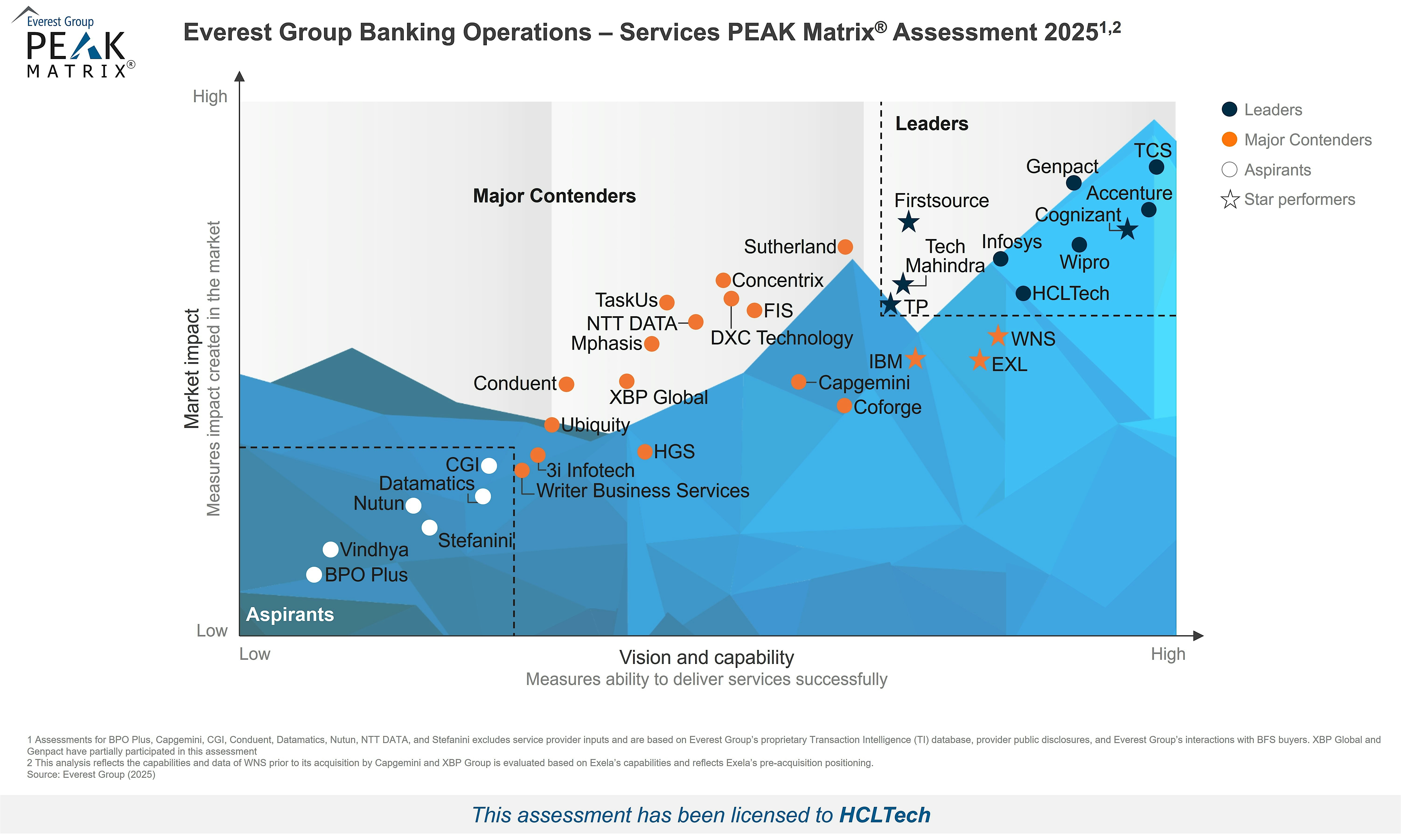

HCLTech has been recognized as a Leader in Everest Group’s Banking Operations Services PEAK Matrix Assessment 2025, which evaluated 34 leading service providers worldwide.

“HCLTech continues to strengthen its banking operations proposition through modular platforms such as Toscana for workflow orchestration, Exacto for document intelligence, and digitalColleague for virtual assistance, enabling banks to scale AI-driven efficiencies across key processes,” said Srawesh Subba, Practice Director, Everest Group.

“HCLTech’s focus on operationalizing GenAI through practical use cases and adopting outcome-linked commercial constructs, combined with strong client recognition for responsiveness and crisis handling, enhances its execution credibility. These strengths have contributed to HCLTech’s position as a Leader in Everest Group’s Banking Operations Services PEAK Matrix Assessment 2025.”

Key highlights of the report:

- HCLTech provides integrated front-to-back coverage across retail, commercial, lending, payments, and financial crime, enabled by a unified operating model and workbench

- It offers modular banking platforms and accelerators, such as Toscana for workflow orchestration, Exacto for document intelligence, and digitalCOLLEAGUE for virtual assistance, enabling end-to-end automation and contextual decisioning across banking processes

- It supports outcome-linked, risk-sharing models under its BPO 3.0 repositioning, aligning commercial constructs to measurable business value

- HCLTech operationalizes GenAI through use cases, including multilingual virtual assistants (iGenie), automated email triage (EAR), enabling reduced manual effort, faster dispute resolution, and improved customer experience

- Buyers highlighted consistent responsiveness, crisis handling, and account-level proactive management as key engagement differentiators

Disclaimer

Licensed extracts taken from Everest Group’s PEAK Matrix® Reports may be used by licensed third parties for use in their own marketing and promotional activities and collateral. Selected extracts from Everest Group’s PEAK Matrix® reports do not necessarily provide the full context of our research and analysis. All research and analysis conducted by Everest Group’s analysts and included in Everest Group’s PEAK Matrix® reports is independent, and no organization has paid a fee to be featured or to influence their ranking. To access the complete research and to learn more about our methodology, please visit Everest Group PEAK Matrix® Reports.

HCLTech has been recognized as a Leader in Everest Group’s Banking Operations Services PEAK Matrix Assessment 2025, which evaluated 34 leading service providers worldwide.

“HCLTech continues to strengthen its banking operations proposition through modular platforms such as Toscana for workflow orchestration, Exacto for document intelligence, and digitalColleague for virtual assistance, enabling banks to scale AI-driven efficiencies across key processes,” said Srawesh Subba, Practice Director, Everest Group.

“HCLTech’s focus on operationalizing GenAI through practical use cases and adopting outcome-linked commercial constructs, combined with strong client recognition for responsiveness and crisis handling, enhances its execution credibility. These strengths have contributed to HCLTech’s position as a Leader in Everest Group’s Banking Operations Services PEAK Matrix Assessment 2025.”

Key highlights of the report:

- HCLTech provides integrated front-to-back coverage across retail, commercial, lending, payments, and financial crime, enabled by a unified operating model and workbench

- It offers modular banking platforms and accelerators, such as Toscana for workflow orchestration, Exacto for document intelligence, and digitalCOLLEAGUE for virtual assistance, enabling end-to-end automation and contextual decisioning across banking processes

- It supports outcome-linked, risk-sharing models under its BPO 3.0 repositioning, aligning commercial constructs to measurable business value

- HCLTech operationalizes GenAI through use cases, including multilingual virtual assistants (iGenie), automated email triage (EAR), enabling reduced manual effort, faster dispute resolution, and improved customer experience

- Buyers highlighted consistent responsiveness, crisis handling, and account-level proactive management as key engagement differentiators

Disclaimer

Licensed extracts taken from Everest Group’s PEAK Matrix® Reports may be used by licensed third parties for use in their own marketing and promotional activities and collateral. Selected extracts from Everest Group’s PEAK Matrix® reports do not necessarily provide the full context of our research and analysis. All research and analysis conducted by Everest Group’s analysts and included in Everest Group’s PEAK Matrix® reports is independent, and no organization has paid a fee to be featured or to influence their ranking. To access the complete research and to learn more about our methodology, please visit Everest Group PEAK Matrix® Reports.