Fraudulent activities in financial transactions pose a complex, multi-dimensional challenge for institutions, resulting in significant financial losses, operational strain and erosion of customer trust. Traditional fraud detection systems often rely on rule-based mechanisms that struggle to adapt to sophisticated, evolving fraud patterns and are prone to high false positives, delayed detection and limited contextual analysis.

Compounding this are issues such as inconsistent data across channels, high alert volumes, siloed investigation processes, limitations of legacy systems, and increasing regulatory pressure. These fragmented systems hinder real-time fraud resolution, overwhelm investigation teams and impair customer experience.

FraudShield addresses this compounded challenge through an Agentic AI-driven approach to deep, real-time financial transaction fraud investigation, setting a new benchmark in accuracy, scalability and compliance for modern fraud prevention.

Core challenges in legacy fraud investigation system

Financial organizations face several persistent challenges:

- High false positives: Traditional systems often flag legitimate transactions as probable fraud, creating operational inefficiencies

- Integration and scalability issues: Legacy system complexities hinder real-time fraud supporting evidence/insights at scale

- Detection latency: Delayed response times result from traditional ML models with limited context awareness, multi-step evaluation cycles and difficulty correlating complex fraud indicators across data sources

- Poor customer experience: A lack of coordinated communication across departments, combined with long investigation timelines, leads to impersonal responses and diminished customer trust

- Compliance and reporting barriers: Difficulty in generating accurate, timely reports risks regulatory non-compliance

- Operational inefficiencies: Manual processes inflate costs and resource utilization

These challenges call for an intelligent, real-time and scalable fraud investigation framework that not only detects but also deeply investigates suspicious activities.

Introducing FraudShield

FraudShield leverages a multi-agent AI architecture powered by advanced Machine Learning and Generative AI models to redefine how financial institutions approach fraud detection and investigation.

Key features of the FraudShield solution:

- Real-time monitoring and deep investigation: Intelligently manages the entire fraud lifecycle, from real-time detection to secure and timely customer engagement, minimizing delays and manual intervention

- Seamless integration with legacy and modern systems: Designed with a modular, scalable architecture to smoothly integrate with both legacy infrastructures and modern platforms

- Empathetic customer support: AI-driven sentiment analysis of customer interactions ensures responses are professional, context-aware and trust-preserving

- Compliance-ready reporting: Automated, audit-friendly fraud reports in line with standards like GDPR and PCI DSS

- Operational efficiency: Streamlined processes reduce reliance on manual tasks and minimize investigation delays, boosting overall productivity

FraudShield process flow

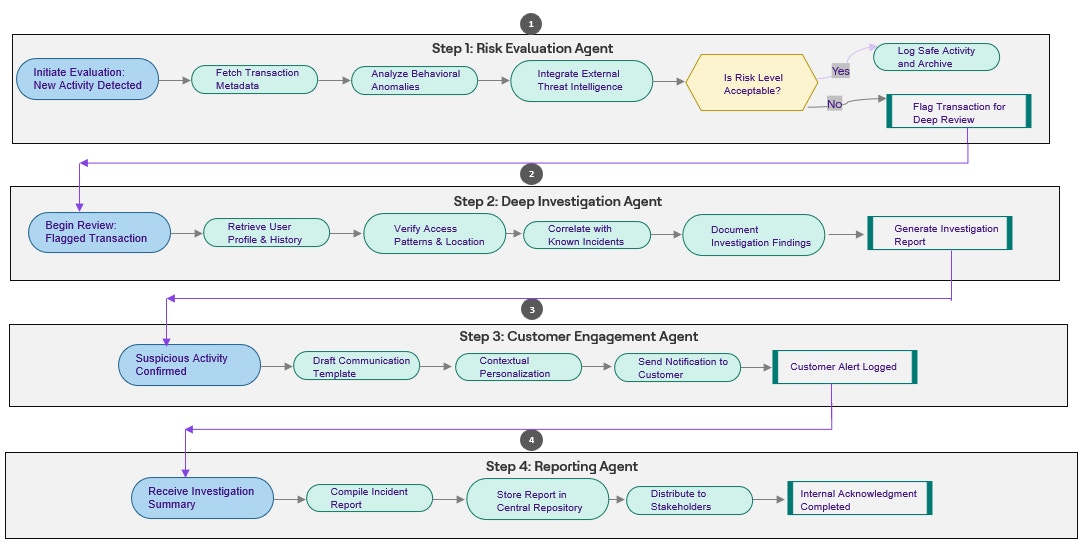

FraudShield operates through a multi-agent collaboration and a specialized role Agentic architecture pattern (ref), covering a four-step process to ensure comprehensive fraud detection and resolution.

Figure1: FraudShield process flow

User story:

You’re the head of fraud operations. Overnight, your legacy system spits out hundreds of alerts. Investigators are overwhelmed, customers are angry, and regulators want answers. FraudShield takes that pile of noise and turns it into disciplined work you can act on. Fast, traceable and with clear next steps.

The run-through (what happens, step by step)

- Risk evaluation Agent - The front line

- Watches incoming transactions and fetches transaction metadata, behavioral signals and external threat feeds

- Scores risk and decides whether an item can be archived as safe or must move to deeper review

- Outcome: far fewer noisy alerts reach investigators; real risks are prioritized

- Deep investigation Agent - The investigator

- Pulls user profile, transaction history, device and location checks, merchant reputation and known incident data

- Verifies access patterns, correlates anomalies across sources and produces a concise investigation record with clear reasons for its conclusion

- Outcome: Only high-confidence cases are escalated, false positives drop because decisions include context, not just rules

- Customer engagement Agent - The human touch at scale

- Builds a context-aware message based on the investigation, adapts tone using sentiment signals and delivers the notification through the preferred channel

- Captures customer replies and feeds responses back into the case record for rapid resolution

- Outcome: Customers get timely, professional communication and you reduce callbacks and manual outreach

- Reporting Agent - The audit trail

- Compiles investigation findings into a compliance-ready report, stores the record centrally and distributes updates to the right stakeholders

- Keeps a full trace of decisions so auditors and regulators see why a case was closed or escalated

- Outcome: Reporting is consistent, repeatable and far less manual

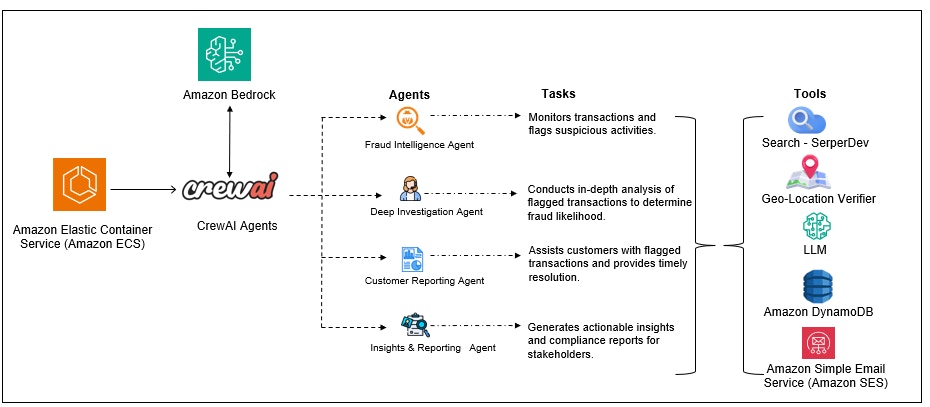

Technical architecture

FraudShield’s architecture is built on AWS GenAI tech stack for scalability, resilience and real-time performance. Below are the AWS services used for implementing FraudShield:

- Amazon ECS hosts CrewAI multi-agent orchestration platform and services

- Amazon Bedrock powers intelligent investigation by providing unified access to models like Amazon Nova Pro and Anthropic Claude for generating deep insights

- Amazon DynamoDB stores transaction metadata and investigation logs

- Amazon SES manages real-time customer notifications

- Geo-Location Verifier enhances the accuracy of transaction location validation using OpenStreetMap-based coordinate services. Search integrations enrich investigation with external fraud pattern sources

Figure2: FraudShield Technical Architecture

Target industries and applications

FraudShield is designed to cater to industries with high transactional activities:

- Financial Services: Banks, payment gateways, insurance companies

- Ecommerce and Retail: Combating online payment fraud

- Travel: Airlines and hotels facing booking fraud

- Healthcare: Medical billing and insurance claim fraud detection

- Telecom: Subscription and payment fraud prevention

Conclusion

Legacy fraud detection systems often fall short due to high false positives, delayed investigation timelines, limited contextual analysis and poor integration capabilities, leading to operational inefficiencies and a decline in customer trust.

With its intelligent, real-time and scalable Agentic AI approach, FraudShield not only helps organizations minimize fraud losses but also enhances customer trust, ensures regulatory compliance and optimizes operational efficiency.