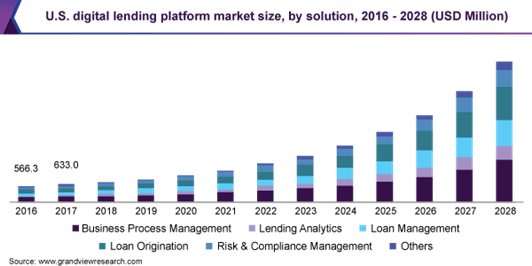

The face of lending has changed – from large banks and financial institutions to online consumers and lenders. With the pandemic mandating social distancing and lockdowns, businesses and individuals are looking for lenders that can perform the borrowing journey remotely and faster than before. Consequently, the competition is going digital. The global digital lending platforms market is already worth USD 4.87 billion and is poised to grow at a CAGR of 24% between 2021 and 2028. For traditional lenders, the competition now is with technologically-advanced firms, apart from big lenders.

Legacy loan origination processes have long been a major pain point for global lenders – from meeting the changing regulatory norms to error-prone manual processes. All of these lead to risky, long waiting periods for customers and create an undesirable lack of transparency. But, with advanced lending digital solutions powered by intelligent automation and machine learning, lenders can transform their operations to reduce errors, stay up to date with regulations, and provide a transparent system for their customers. To survive, lenders have no choice but to jump on to this digital bandwagon, and rethink their processes and operational models using deep learning technologies to improve customer experience.

Moving beyond traditions and legacies

Lending solution providers have largely been dependent on manual processes. The legacy loan origination process is fraught with issues of efficiency and speed. A recent survey reported that 46% of lenders took at least five weeks to approve a loan. The seven phases of loan origination involve extensive paperwork, validations, and management. Owing to the error-prone manual process, lenders have struggled to curtail operational costs and prevent delays. This has resulted in 69% of borrowers losing patience and leaving the lending application midway in 2020.

Documentation and underwriting worries aside, the staff have also been experiencing constraints due to the remote working situation. The absence of physical checks and field visits due to remote working has impacted loan quality. Remote working has also compelled many lenders to explore digital closing options. Video communications and e-signing of documents have thus become popular alternatives. Such digital efforts do not prevent information overload, meet changing regulatory requirements, ensure process flow transparency, and manage credit risks.

If the goal is to raise profitability and create stakeholder value, lenders must focus on removing the complexities by minimizing human intervention. Digital solutions to improve operational efficiency and introduce robotic process automation into processes can help streamline workflows. Robotic process automation (RPA) reduces the time for performing rule-based tasks, such as flood certification, employment verification, appraisal, document ingestion management, quality control, and assurance etc., from a span of hours to a couple of minutes. Combined with machine learning analytics and artificial intelligence (AI), it can further enhance value generation from the already collected data and improve customer experience.

Maximizing lending value with intelligence

Lending analytics has been garnering high interest in the BFSI industry for its ability to improve customer acquisition through behavior analysis and customer segmentation. This can completely transform lead management and reduce the time taken for converting leads and assessing customer credits. Leveraging machine-learning algorithms, lenders can gain valuable insights for maximizing value for customers and building loyalty, by offering more personalized products and services.

Another key innovation is intelligent automation, which can positively impact the entire lending value chain, from origination through servicing and management, to ancillary services. Along with automating routine activities, lenders can reduce manual errors through smart document intake, processing, storage, and categorization. Cognitive decision-making helps workers by assuring the verification of documents, resulting in a significant time reduction of the approval process from weeks to days. Ultimately, intelligent automation simplifies and accelerates all workflows, allowing complete transparency. Any digressions can be identified in real-time, enabling the lenders to save millions in frauds and regulatory issues.

To ensure optimum performance of such an AI-enabled solution, lenders will need to establish a strong IT team with expertise in mapping all the appropriate levers. Just transforming business operations will not be enough. Rather, measuring the tangible and intangible benefits would be key to continuously improve the system for future business resiliency.

Reinventing for the future

As the pace of digital transformation continues to accelerate, lending organizations have to find ways to rapidly adapt and get ahead of the curve to become future-ready. The core of such a transformation requires them to focus on several dimensions as they go forward – enhancing customer experience, improving employee experience, reducing operational costs, finding new business opportunities that contribute to the top line, and mitigating compliance risks.

Achieving all critical business goals requires partnering with a robust technology and service ecosystem. This will need businesses to take advantage of best-in-class, next-generation technologies to help them innovate their business operations. Be it leveraging deep learning, natural language processing, or process automation, only by adopting such solutions will they be able to increase their customer reach and satisfaction, as well as accelerate growth.

As the process-driven, lending-solutions businesses continue their journey toward greater process optimization, the day is not far when even pandemics or disasters would only minimally affect enterprises. Lenders will have the resiliency to find the best products for potential borrowers and continue to create real value for all stakeholders.