‘Your big opportunity may be right where you are now.’ – Napoleon Hill

Tariff saga unfolds

In a sweeping declaration that was not entirely unanticipated, on April 2 US President Donald Trump imposed reciprocal tariffs on almost all trading partners with a 10% baseline duty on all imports. Speaking from the Rose Garden, he called it a “declaration of economic independence.” Countries like Taiwan were levied 32%, Vietnam 46%, India 26% and the big daddy of all, China, with a whopping 245%! When Charles Dickens had penned the lines – ‘It was the best of times, it was the worst of times… it was the season of light, it was the season of darkness…’, did he envisage this particular moment in US trade policy? It's unlikely – yet a highly relatable scenario, as it turns out.

Disruptions galore

The nations mentioned above are a few from which apparel retailers in the US source their raw materials. In a less-than-superlative environment, workers slog hours to create the fancy garments that eventually make their way to places like New York Fifth Avenue, only to be displayed with a hefty price tag in tow. With elevated tariffs, the final selling price will increase again, leading to an elevated price regime for imported items in retail. As we can imagine, this throws any planned forecasting, assortment planning, merchandising, sourcing strategy, pricing and supply chain in disarray.

The macro situation is compounded further by the fact that interest rates remain elevated, bond markets signal concern and capital becomes increasingly expensive to access. Consumers will roll back on discretionary purchases and trade down in non-discretionary categories.

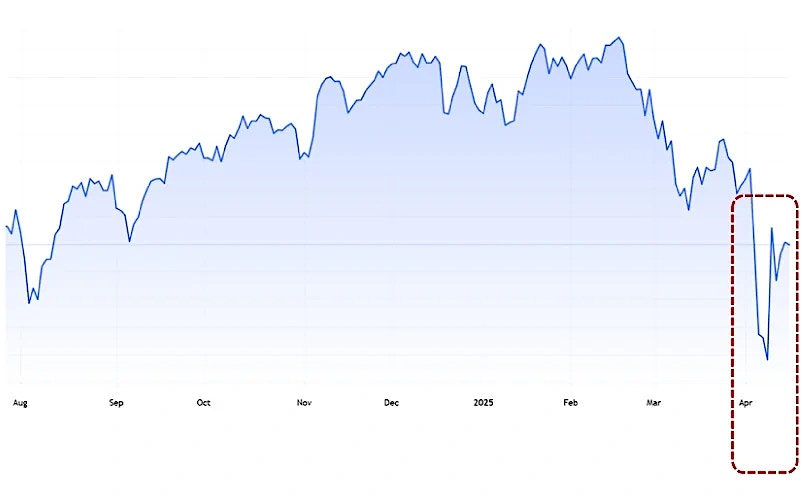

No wonder the S&P 500 and other indices saw massive corrections in the week of April 2 and beyond.

S&P 500 movement – last 9 months

(Source: https://www.investopedia.com/markets/quote?tvwidgetsymbol=spx)

Opportunity in adversity

While the immediate effects will be disruptive for retailers, there is a silver lining to this saga, which firms can test check and make business as usual over months and years to come. Let us explore a few of those.

- Sourcing risk evaluation – A few SKUs may be bearing the input cost burden significantly more due to elevated tariffs. A breakdown into the BOM structure for the top revenue-earning SKUs (ABC classification), followed by risk profiling of the BOM components to arrive at a consolidated risk score for the SKU, can signal any necessary actions. This could be built as a prescriptive model, where the eventual goal is to provide suggestions of alternate suppliers, sourcing geographies and similar SKU profiles for alternative buying – all of which become inputs to the retailer buying organization. In the process, exploring near-shore sourcing options for speed-sensitive programs can also be built in, especially if BOM ingredients favor a better COGS structure in the changed tariff regime.

- Assortment streamlining – An allied area of focus can be determining the optimal assortment mix, taking into consideration sales velocity, margins contributed, brand relevance and most importantly the price elasticity for the specific SKU within the assortment. Improved assortment mix modeling using the above parameters, alongside factoring in heightened cost structure for input ingredients on account of tariffs, can prescribe the right mix of SKUs. A streamlined assortment will lead to faster reads, leaner buys and fewer markdowns, protecting margins without losing brand relevance.

- Relook at forecasting strategy — This phase can be utilized to test demand forecast strategy, particularly for SKUs that would have been hit by elevated tariffs. Forecast parameters, KPIs around tracking signals, forecast algorithms and an external set of parameters (including macro signals) can be re-evaluated to improve forecast accuracy.

- Stress test pricing — A major positive fallout of this phase could be retailers gaining greater insights into their pricing strategy and frameworks. Understanding how much demand erosion happens due to price fluctuations can help to enhance price elasticity models at the retailers’ end. Factoring this in while evaluating demand forecasts will be essential.

- Check promotional efficacy – Markdowns, promotions and LTOs will be imperative to offload excess inventory that may have been stocked initially, blocking off shelf space and storage areas. Introducing promotional models that have greater ROI, including rolling out LTOs at individual store and catchment area levels, would be crucial to reducing inventory DOH. This will be more critical for retailers dealing in perishables, like F&B items and food ingredients.

Early movers will have the advantage

The next two quarters will be decisive for retailers to pressure-test their assortment, loyalty, sourcing, demand signals and pricing approaches. While the situation continues to evolve and will likely stay volatile for months on end, firms that act first will lead the charge. Technology and digital vendor partners, including large SIs, that have the right skillset mix of domain, data and technology can also be of enormous help in such tumultuous times.

Napoleon Hill certainly did not have tariffs on his mind when he coined his famous adage mentioned at the outset. However, faced with a volatile macro situation, retailers can have their moment under the sun right now. Doubling down over the next quarter will set the pace for retailers leading this charge in the near future.

The rest will be placid followers.