Introduction

Health plans are on the brink of a transformative era, driven by emerging regulatory mandates that will redefine benefit design, pricing strategies, network standards and member transparency. The Inflation Reduction Act (IRA) and new CMS rules on mental health parity and price transparency are among the key changes that will have profound implications for medical loss ratios (MLRs), drug spending and administrative capacity.

These regulatory changes are not just isolated rule adjustments; they represent a broader push toward affordability, transparency, equity and digital modernization in the healthcare landscape. Health plans that adopt a proactive, technology-driven approach can turn these regulatory pressures into strategic advantages. By implementing automated regulatory monitoring, modernized core platforms, robust data management, consumer-centric digital tools and a future-ready delivery model, health plans can effectively reduce compliance risks, accelerate speed-to-value and enhance operational efficiency and member experience. These mandates are part of a broader national roadmap aimed at solving long-standing challenges in US healthcare:

- Cost sustainability: Addressing high drug prices and over-utilization

- Consumer protection: Enabling greater transparency and financial clarity

- Health equity: Ensuring access to mental health and essential services

- Technology modernization: Driving interoperability and digital-first engagement

A recent PwC Global Compliance Survey* found that 71% of executives anticipate undertaking digital transformation initiatives to support compliance efforts over the next three years. Proactive adaptation can unlock long-term operational advantages and market leadership for health plans. In this blog, we will explore how regulatory change is impacting health plan operations and outline five strategic shifts that can help them move from compliance obligation to operational advantage.

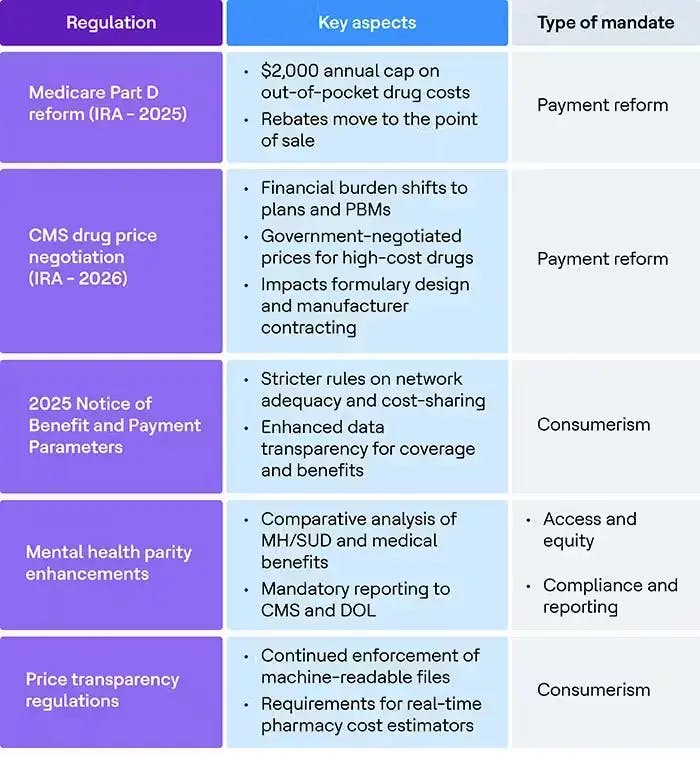

Key regulatory changes

Health plans are facing a wave of regulatory mandates, each targeting a specific facet of healthcare reform. The table below categorizes the most significant mandates and highlights their operational focus to help health plans prioritize and respond strategically.

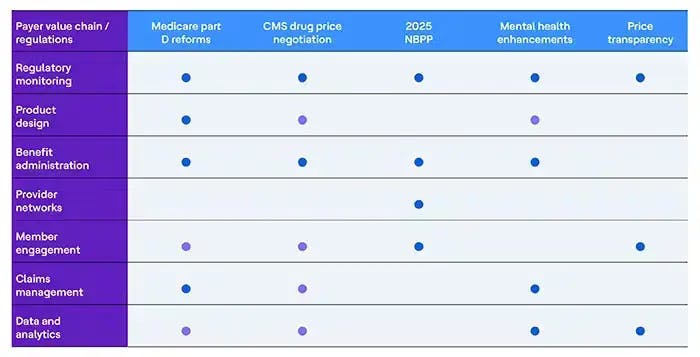

Regulatory mandates: Impact across the value chain

This table illustrates how major upcoming and ongoing regulations, such as Medicare Part D reforms, CMS drug price negotiation and price transparency, affect different components of a health plan’s value chain. Payers can better prioritize their transformation and compliance efforts by mapping regulations to impacted functions like product design, claims management and member engagement.

Navigating regulations: Operational impact and strategic imperatives

Health plans must modernize how they operate, report and engage with members to respond effectively to the regulatory impacts. It’s not enough to stay compliant; the real opportunity lies in transforming compliance into an operational advantage.

Outlined below are five strategic imperatives that health plans should prioritize to achieve that goal:

GenAI-based automated regulatory monitoring and impact identification

Automated monitoring of regulatory changes at federal and state levels should be integrated into the compliance lifecycle to flag, assess and trigger downstream operational updates in real time.

- Deploy tools for real-time monitoring of CMS, HHS and state DOIs

- Automate mapping of regulations to internal business rules and operational domains

- Use AI-based impact modeling to predict effects on MLR, benefit design and reporting

Enhanced core administration platforms with intelligent automation

Legacy core platforms often struggle with the agility required by regulatory shifts. Upgrading to modern admin systems is essential to reduce administrative costs, accelerate time to market and improve operational agility.

- Automate key workflows such as prior authorization, grievance, appeals and benefit updates by leveraging GenAI/Agentic AI

- Leverage document intelligence to enable real-time access to policy, benefit and formulary documentation

- GenAI-based product configuration to support IRA or parity-driven product design changes

Robust data management for compliance and quality reporting

Health plans need a foundational data strategy that supports clean, normalized and accessible data across business domains, especially provider directories, parity analysis, price transparency and CMS reporting.

- Establish data stewardship and lineage across membership, claims and provider data

- Create compliance-specific data marts for faster audit response and report generation

Personalized consumer experience through digital engagement tools

Build consumer-facing digital tools that can deliver personalized information to improve satisfaction and reduce the burden on support teams.

- Enable members to access real-time, personalized cost estimates and benefit information

- Provide digital consumer engagement tools that comply with CMS rules and enhance convenience

- Use regulatory touchpoints as educational opportunities to guide members to affordable and appropriate care

Future-proof operating model with integrated IT, operations and infrastructure services

To remain agile amidst accelerating regulatory change, health plans must evolve from siloed systems and teams to an integrated operating model, merging IT services, business process operations (BPO) and infrastructure under a unified governance and delivery framework. This model promotes clear accountability, minimizes the complexities of managing multiple vendors and strengthens end-to-end ownership. Actionable focus:

- Establish joint governance models and end-to-end workflows that align with regulatory priorities

- Move from a project-based model to a product-centric delivery model, enabling cross-functional teams responsible for overall compliance

- Create cross-functional PODs to rapidly respond to regulatory mandates, reducing hand-offs and execution delays

Conclusion

The healthcare landscape is entering a pivotal phase where health plans must redefine their operational structures and member engagement strategies amid evolving compliance demands. The upcoming mandates are not merely isolated rule changes but represent a systemic, comprehensive push toward affordability, transparency, equity and digital modernization within the healthcare landscape.

Health plans that adopt a proactive, technology-driven approach can transform regulatory pressure into strategic advantages. By implementing the five strategic imperatives outlined in this blog—automated regulatory monitoring, modernized core platforms, robust data management, consumer-centric digital tools and a future-ready delivery model—health plans can effectively reduce compliance risk, accelerate speed-to-value and enhance operational efficiency and member experience.

*PwC’s Global Compliance Survey 2025 (Global Compliance Survey 2025 | PwC)