In today’s volatile business environment, companies need an edge to survive and stay ahead of their competitors. Real-time reporting and analytics in financial reporting is one such edge. Central Finance (CFIN) running on S/4HANA gives companies the speed and agility to replicate their financial documents into the central system, that too, in real time.

Central Finance delivers many benefits, especially in landscapes that are complex within organizations having multiple Enterprise Resource Planning (ERP) systems. Importantly, it provides a route to implementing S/4HANA Finance without causing disruption to an existing source SAP ERP system. Central Finance also offers solutions to corporations struggling with age-old challenges in the financial reporting process, such as delayed finance closing, pulling data from multiple systems, manual adjustments, complex allocations, intercompany adjustments, and more.

Central Finance delivers many benefits for organizations with multiple ERP systems.

Central Finance – A quick-win on the route to S/4HANA

SAP’s intelligent finance on S/4HANA comes with a modern platform and offers cutting-edge analytics and financial reporting capabilities. SAP offers multiple approaches for moving client’s legacy systems onto S/4HANA. However, customers are increasingly looking at alternate deployment options for SAP S/4HANA, since many experienced SAP houses are not entirely convinced about the business case for migrating their heterogeneous system landscape to SAP S/4HANA using SAP’s Greenfield or conversion framework. This is because Greenfield migrations involve disrupting existing IT operations and call for long-running transformation projects, ultimately making them difficult candidates for a justifiable ROI.

SAP offers multiple approaches for moving client’s legacy systems onto S/4HANA.

Customers instead seem to prefer rapid implementations of S/4HANA that provide quick wins like ‘Advanced Analytics and Reporting on S/4HANA’, leveraging new transformed data structure and reporting hierarchies. The idea is that full-fledged S/4HANA implementations with logistics and manufacturing modules can follow later. This is where the SAP S/4HANA Central Finance solution comes in handy.

Essentially, the deployment of Central Finance serves as a gateway or an intermediate step toward an overall S/4HANA roadmap for SAP Finance customers. Over a period, customers may retire source systems one-by-one and move to the S/4HANA landscape.

Prerequisites

CFIN SAP requires limited IT/business resources because customers can connect their SAP ECC and non-SAP systems to a standalone SAP S/4HANA system using Central Finance. Technically, it follows a sidecar approach and leverages SAP’s LT data replication framework to transfer accounting documents in real time from source systems (ECC/Non-SAP) to a target central system (S/4HANA).

Central Finance projects thus ensure almost zero disruption of existing business operations running on SAP ECC, as CFIN implementations run independently, resulting in minor outage during system go-lives. It is integral, though, that SAP solution consultants must be equipped with adequate training on the solutions, tools, and data integration methodologies.

Landscape Requirements

- SAP S/4HANA 1909 or recent edition (Target)

- SAP Landscape Transformation Replication Server

- SAP ECC, R/3 up to lower release 4.6C (Source)

- SAP Master Data Governance – SAP MDG (Optional)

CFIN Architecture Requirements

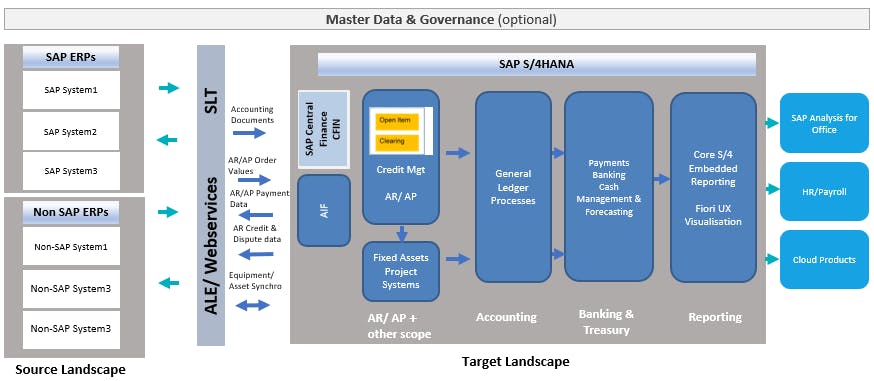

Figure 1: CFIN Architecture Requirements

CFIN Value Scenarios or Business Use Cases

- Central Finance – as Shared Services Accounts Payable center (with central payment)

- Central Finance – as an SAP Group Reporting System (with Analytics Cloud)

- Central Finance – for consolidation of Merger and Acquisition systems

- Central Finance – as a Cloud Integration Hub (Concur, Success Factor, HCP-based apps, etc.)

Solution Approach: Installation and Implementation Strategy

The Central Finance solution involves minimal effort to build and implement. As per SAP, an average-sized Central Finance project should consume 15% of effort and timeline as compared to a full-size SAP implementation project. This is because CFIN projects do not involve significprocess design or build and testing efforts since they are about mapping transaction and master data between two systems. It involves no additions/changes to the existing business processes or rules in the system.

The Central Finance solution involves minimal effort to build and implement.

Here are the key steps involved in Central Finance solution design:

- Identify source systems– SAP ECC, non-SAP systems

- Install target central system– SAP S/4HANA version 1909 or recent

- Activate Central Finance business functions

- Install the SAP LT system, connect the source and target systems (RFC)

- Activate SAP best practices and SAP Group Reporting solution (Optional)

- Configure Central Finance

- Mapping of accounting entities– Key and values mapping

Initial data load:

- Replicate cost objects (for example, production orders) to the central system

- Replicate Financial Accounting (FI) and Management Accounting (CO) documents

- Test and validate postings, perform reconciliations, and sign-off

With this deployment option – alongside S/4HANA implementations – customers also stand to gain significant business value by adopting Central Finance offerings like shared services accounts payables, mergers & acquisition integration, group-level reporting, cloud hub, and more.

Grey Areas in Central Finance

The Central Finance solution is a big bet for SAP’s S/4HANA business. As of the S/4HANA 1909 release, SAP has made most of the promised capabilities available for use. SAP has recently enriched the CFIN solution with features like group reporting (from the 1809 edition onwards), project systems, asset accounting integration, cost component split, and enhanced central payment, etc. The solution also comes with new reporting and reconciliation capabilities. It gets rid of most of the design gaps and bottlenecks that came with the initial release of Central Finance.

However, you do need to be aware of the following limitations:

- CFIN only moves financial postings to S/4HANA. Key functions like logistics, manufacturing, and HR documents are kept outside Central Finance

- Data mapping between the source and target are managed through standard programs. However, SAP also recommends SAP MDG for customers with high data volumes, which is an additional investment

- One of the KPIs to measure a successful CFIN project is minimum data replication errors in the production environment. There are standard error handling capabilities (AIF) available in CFIN for Type-1 scenarios (Source SAP ECC to Target S4H CFIN). The situation gets tougher when it comes to Type-2 scenarios (Source– Non-SAP to Target S4H CFIN). Those often call for enhancements to capture multiple data scenarios

- Limited customer success stories for scenarios like group reporting and the cloud integration hub

- It is important for your IT team to comprehend the CFIN solution and strategize a future S/4HANA roadmap. Often, the scope and capabilities of the CFIN solution are not understood correctly early in the project, leading to mismatched expectations

The CFIN business case finally stacks up

The solution has come a long way since its introduction five years back, when it was known as Central Journals. CFIN now holds much potential value for SAP S/4HANA buyers. Implementations are smoother now because of third-party tools available in the market for complex non-SAP data integrations. Partners are also fueling this journey with the addition of homegrown accelerators and offerings. For example, as a leading CFIN player, HCLTech offers a host of innovative propositions, including the CFIN template solution, CFIN utilities, and accelerators.

The S/4HANA CFIN solution has huge potential for customers looking to explore SAP S/4HANA.

The S/4HANA CFIN solution has huge potential for customers looking to explore SAP S/4HANA. We can summarize the main advantages of adopting CFIN as a deployment option with the points below:

- Reduce (system) complexity

- Increase (process) consistency

- Utilize S/4 HANA speed of innovation

- Greater productivity (due to faster output)

- Growth and scalability (S/4HANA in-built architecture)

- Business impact (nil, due to the non-disruptive deployment approach)

- Faster time to value (due to drastically reduced implementation times as compared to other S/4HANA deployment options)

- Increased cost savings (by gradual decommissioning of systems and associated maintenance costs)

The ideal implementation strategy for SAP finance customers would be to leverage SAP Central Finance to build future analytics, UI, and cloud app strategies. This approach gives businesses a long runway to adopt the vibrant world of S/4HANA and frame implementation strategies, thus helping them derive maximum value and ROI out of their S/4HANA investment.