Experience our transformative GenAI solution that revolutionizes the Insurance Prior Authorization process. This advanced tool automates the verification of incoming documents, such as Prior Authorization (a process where a health insurance company requires a healthcare provider to obtain approval before delivering certain medical services or medications), Requests and EDI (Electronic Data Interchange) transactions, against internal systems and policy documents. It assesses cases for approval, rejection or manual review, offering detailed recommendations. By integrating a user-friendly conversational virtual agent for additional data collection, our solution boosts efficiency, accuracy and speed, enabling payers to make informed decisions and enhance patient care outcomes.

1. Introduction

The insurance industry faces significant operational challenges, including manual document classification, fragmented Prior Authorization (PA) verification, outdated systems, inconsistent decision-making and rising frustration among members and providers. Payers are overwhelmed by paperwork, leading to time-consuming and error-prone processes.

Our solution addresses these challenges by offering an intelligent, autonomous and adaptive approach to streamline the PA lifecycle. It enhances document classification and verification with exceptional precision and speed, seamlessly integrating with existing payer systems to improve compliance and regulatory adherence. This results in enhanced accuracy, faster processing times and a better experience for all stakeholders, ultimately transforming the insurance ecosystem into a more efficient and customer-centric environment.

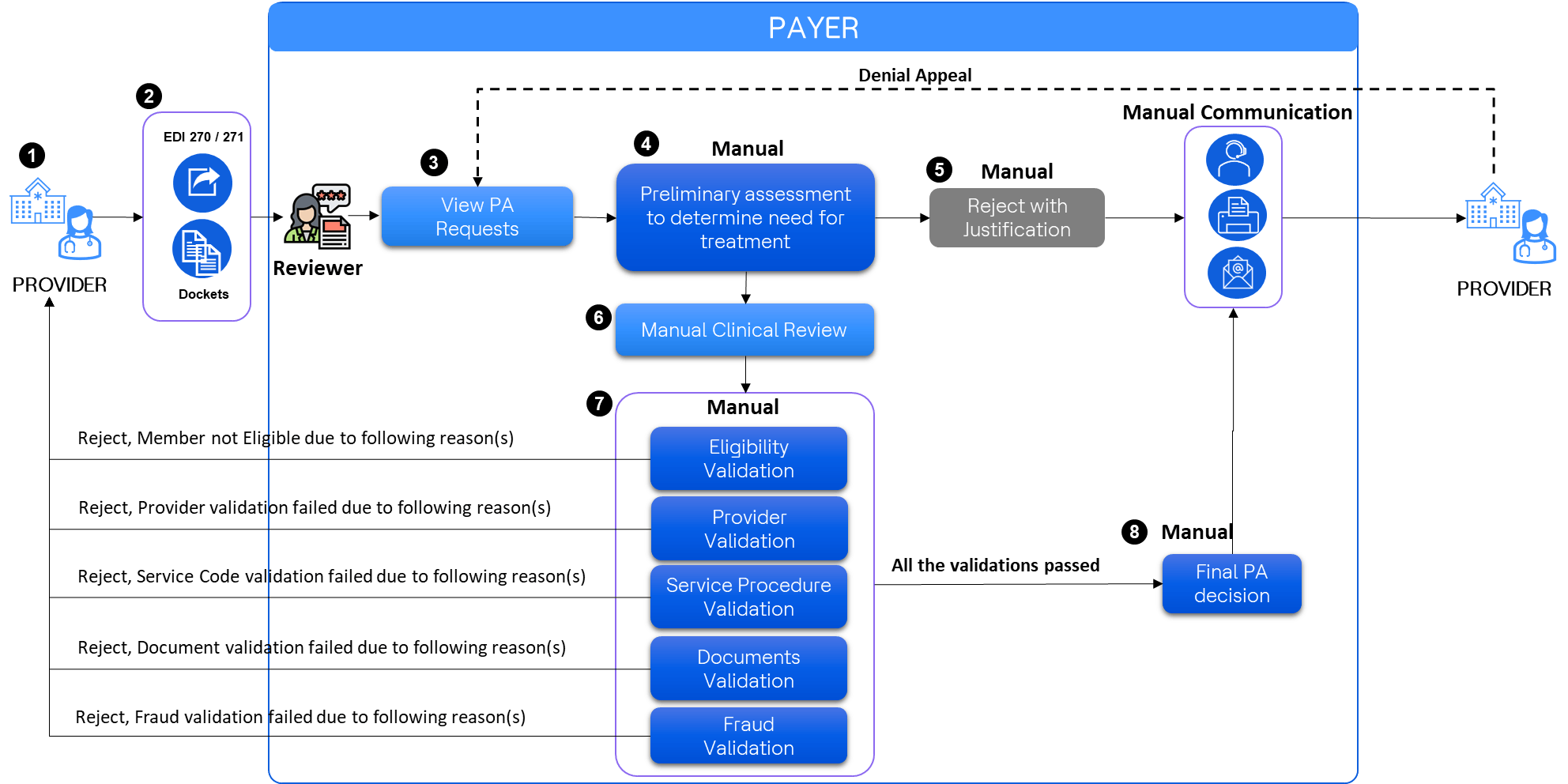

2. As-is Prior Authorization functional flow A manually intensive ecosystem across payer and provider back offices with a high turnaround time (over 7 days).

The system uses two personas:

- Providers – A healthcare provider is an individual (like a doctor or nurse) or entity (like a hospital or clinic) that delivers medical services to patients

- Payers - Insurance payers are entities that cover healthcare costs for individuals, government programs and private companies

PA request journey in the current process:

- The provider generates the PA request

- The provider sends Electronic Data Interchange (EDI) 270 / 271 details (information about the patient’s coverage and benefits) to the Payer

- The reviewer from the Payer side receives the Prior Authorization details and the documents

- A preliminary review determines whether the treatment details and necessary documents are correct and sufficient

- If the preliminary review does not provide necessary details, the rejection justification is entered manually into the system and communication (via call, email or fax) along with the justification is sent to the provider

- If the preliminary review has all the details, the request for a ‘Manual Clinical Review’ is sent to a reviewer

- The reviewer manually starts validating eligibility, provider, service procedure, documents and fraud. If any validation fails, the rejection justification is entered manually into the system and communication (via call, email) along with the justification is sent to the provider

- If all the validations pass, the final PA decision is made and entered manually into the system and communication (via call, email, fax) along with the justification is sent to the provider

Challenges in the current Prior Authorization process:

- Extended verification duration: The time required to verify each prior authorization is excessively long, resulting in significant delays in healthcare delivery. This delay often leads patients to discontinue their prescribed treatment regimen

- High denial and appeal rates: According to the American Medical Association (AMA), prior authorization denials occur approximately 31% of the time, with appeals comprising about 20% of submissions. Source: [AMA Prior Authorization Survey] (https://www.ama-assn.org/system/files/prior-authorization-survey.pdf )

- Regulatory compliance: The Centers for Medicare and Medicaid Services (CMS) has mandated the Interoperability and PA Final Rule (CMS-0057-F), which is scheduled for implementation by January 1, 2026/2027

- Inefficient manual verification: The current manual verification process is not comprehensive. Reviewers often reject prior authorizations based on the first incorrect item, necessitating multiple resubmissions and verifications. Each iteration requires approximately 1 hour and 15 minutes of the reviewer’s time

- Manual document categorization and completeness checks: The process of categorizing and verifying the completeness of documents is performed manually, adding to the workload and potential for errors

These challenges highlight the need for a more efficient, transparent and automated prior authorization verification process to enhance patient care and operational effectiveness.

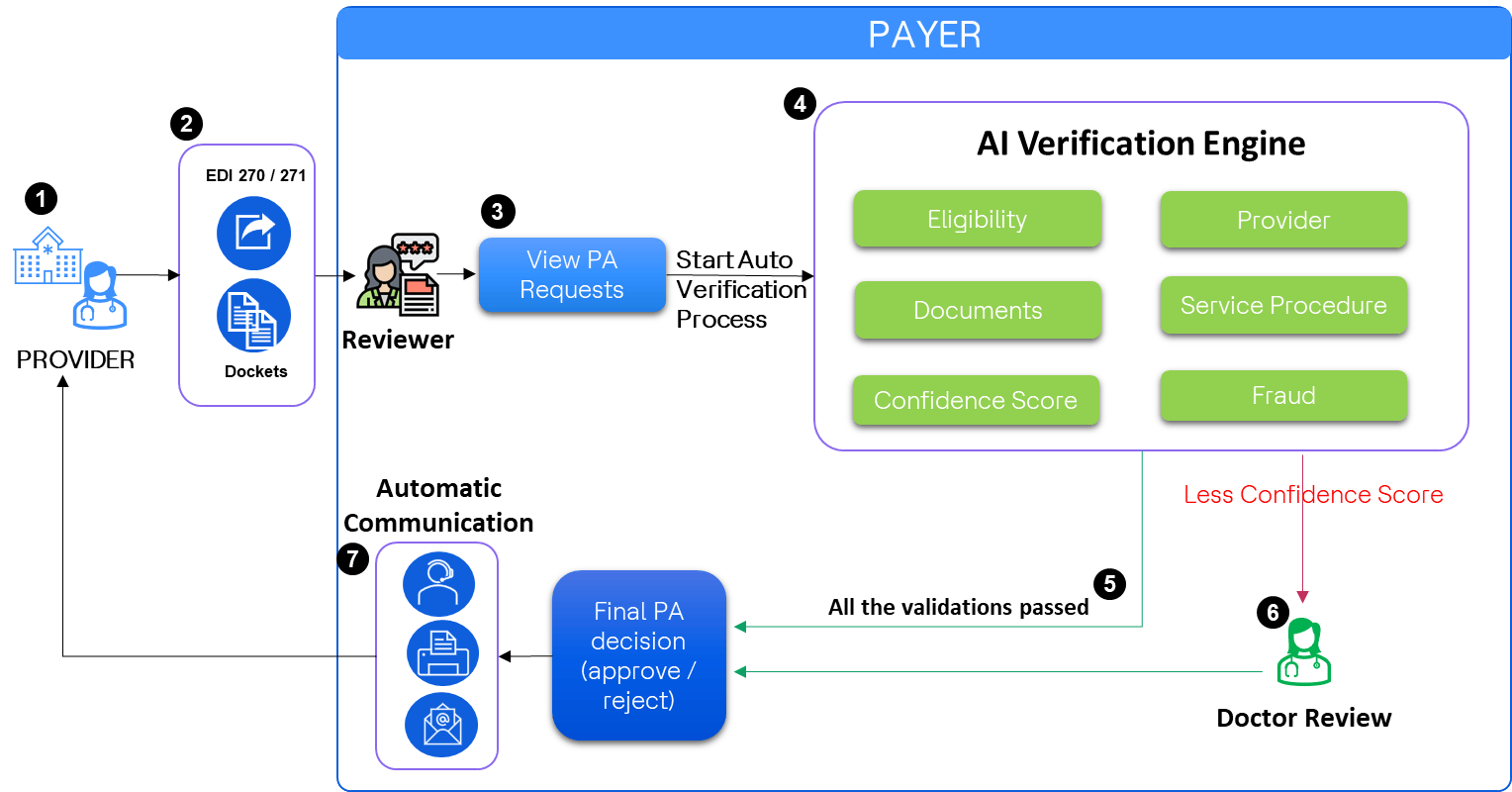

To-be functional flow:

The proposed AI Engine verification reduces the turnaround time from 7 days to less than 10 minutes.

PA request Journey with AI-powered verification process:

- The provider generates the PA request

- The provider sends Electronic Data Interchange (EDI) 270 to the Payer

- The reviewer from the Payer side receives the details of the PA request and the documents shared along with the request

The reviewer initiates the AI Verification Engine, which performs internal verifications across 25+ criteria. These criteria include:

- Eligibility

- Provider credentials

- Document authenticity

- Service procedure compliance

- Confidence score assessment

- Fraud validation

The confidence score gets calculated based on every successful/unsuccessful verification

- If the confidence score exceeds the predetermined threshold, the verified details are forwarded to the decision module

- If the confidence score is below the threshold, the request is directed to a doctor for manual review. Their findings are then submitted to the decision module

- Upon receiving the decision, the system automatically communicates the outcome (approved, rejected, or requiring additional information) to the provider via email. The communication includes a detailed justification for the decision.

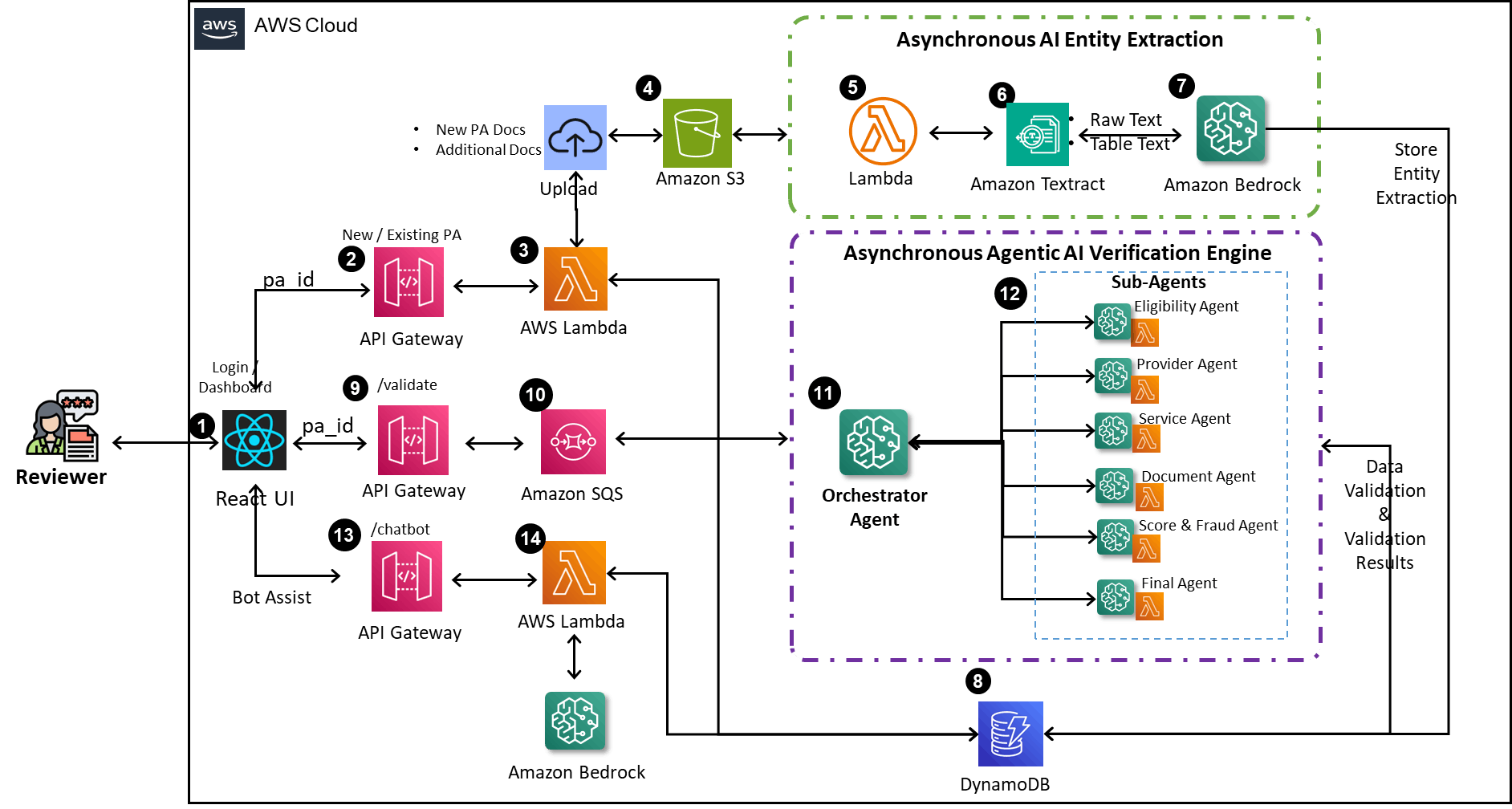

3. Technical architecture (Agentic AI)

The overall solution is divided into the following processing layers:

- Asynchronous AI entity extraction: The entities from structured or unstructured documents specific to Prior Auth Request are extracted and stored in the database

- Asynchronous Agentic AI verification engine: The system asynchronously invokes an Agent that will verify at various levels using sub-agents to understand the request, formulate the context and finally generate the response based on the outcome of all the sub-agents

GenAI-infused Prior Authorization architecture diagram flow:

- The user interacts with the system through a React-based application interface. The React app container is deployed using a cost-optimal AWS Microservice-based architecture, leveraging Amazon ECS Clusters and AWS Fargate

- The UI facilitates the creation of a new Prior Authorization request, including the submission of PA documents

- Behind the API Gateway, a Lambda function captures the PA request details and persists them in Amazon DynamoDB

- The submitted documents are uploaded to Amazon S3 Buckets, which are associated with the specific PA request ID

- Upon document upload to the S3 bucket, an event is triggered, initiating an asynchronous AI Entity Extraction Lambda process

- The document details are sent to Amazon Textract for the extraction of raw text, table text and images

- Amazon Bedrock multi-modal processes the extracted data to identify and format entities from the raw text, table text and images for future processing

- The extracted entities are persisted into the DynamoDB for subsequent usage

- The reviewer invokes the validation process to commence

- The validation process sends a message to Amazon Simple Queue Service (SQS) to ensure the process operates asynchronously

- SQS triggers an Agentic AI multi-agent framework, Orchestrator Agent, which coordinates the activities of various sub-agents

- The Bedrock Agentic AI Orchestrator Agent determines which sub-agent to call and sends appropriate parameters. The sub-agent performs the validation and returns individual responses to the Orchestrator Agent. The Orchestrator Agent then collects, consolidates and enhances these responses before sending a comprehensive reply to the user, while also persisting the agents’ responses

- In case of any queries, the user can initiate a thread with an intelligent conversational assistant (chatbot) and ask questions related to the specific Prior Auth Request

- The conversational assist Lambda function communicates with Amazon Bedrock, which maintains the complete context of the Prior Auth Request, to obtain accurate responses to the user’s queries

4. Conclusion

GenAI infusion in the Insurance Prior Authorization process represents a significant leap forward in healthcare administration. This solution addresses the industry's operational challenges head-on by automating document verification, enhancing decision-making and improving communication. It promises to reduce verification times, lower denial and appeal rates and ensure regulatory compliance. The user-friendly virtual agent streamlines the process, offering real-time assistance and insights. Embracing this technology enhances efficiency and accuracy and transforms the patient care experience, marking a new era in the insurance ecosystem.