In recent years, the concept of environmental, social and governance (ESG) frameworks has gained significant attention in the corporate world and investment landscape. As concerns about climate change continue to increase, assessing and mitigating climate risk has become a crucial aspect of sustainability journey. This post aims to shed light on climate risk, its implications for businesses and investors and the steps being taken to address this pressing issue.

What is climate risk?

Climate risk refers to the potential negative impact of climate change and environmental factors on a company's long-term performance. It includes challenges like extreme weather events, resource scarcity, rising sea levels and regulatory changes. As climate change becomes more evident, businesses face increased risks, including physical, transitional and reputational risks.

The importance of climate risk assessments

Understanding and addressing climate risk is crucial for companies and investors to achieve sustainability goals. The possible consequences of these risks are:

- Ignoring risks can lead to financial consequences such as reduced shareholder value, stranded assets and legal liabilities.

- Businesses that fail to adapt to sustainable practices may suffer reputational damage and loss of market share.

Benefits of climate risk assessments

- Investors can benefit from incorporating climate risk analysis into their decision-making processes, as it helps identify companies better prepared for climate change challenges.

- By allocating capital towards sustainable and resilient companies, investors contribute to a more sustainable future.

- Regulatory requirements are also emerging to manage emissions and promote sustainable lending and investment practices.

- Businesses can move toward achieving their long-term sustainability goals.

Managing climate risk

Recognizing the importance of climate risk, businesses and investors are taking the below proactive steps to manage and mitigate these risks effectively:

Risk assessment and scenario analysis

Companies conduct climate risk assessments and scenario analyses to understand exposure and develop strategies for adapting to changing environmental conditions.

Disclosure and reporting

Enhanced climate-related disclosure and reporting practices provide investors with transparency on a company's climate risk management. The Financial Stability Board's Task Force on Climate-related Financial Disclosures (TCFD) report offers guidelines for reporting climate-related risks and opportunities.

Sustainable investment practices

Investors and lenders are integrating ESG aspects, including climate risk, into their investment decision-making processes. This approach involves considering a company's climate risk exposure, carbon footprint and sustainability practices to identify investment opportunities aligned with long-term climate objectives.

Collaboration and advocacy

Businesses are increasingly collaborating with stakeholders, including governments, NGOs, and communities, to collectively address climate-related challenges. Additionally, companies are advocating for policy changes that promote sustainability and provide a conducive regulatory environment.

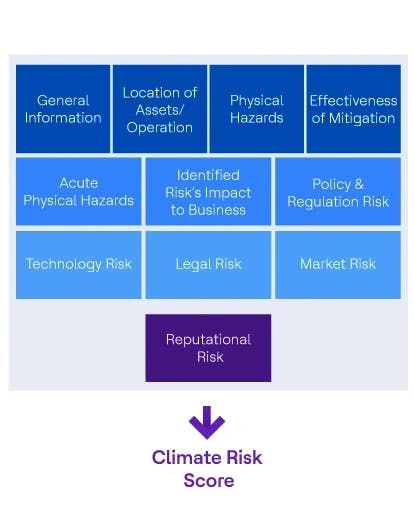

Information required to perform climate risk rating

The following model shows the critical information requirements needed to calculate the climate risk rating:

ESG climate risk assessment for banks

To create a model for a bank to determine climate risk scores, several factors should be considered:

Define climate risk metrics

Identify key climate risk metrics that are relevant to the banking industry.

- The climate risk metrics may include physical risks, transitional risks and reputational risks.

- Develop a scoring system or scale to quantify and rank the severity of each risk metric.

Data collection

Collect reliable, accurate and up-to-date data on climate risks from internal sources, such as energy consumption, emissions, external sources — e.g., climate models, weather data —and industry-specific data from regulations and benchmarks.

Risk assessment and analysis

Conduct a comprehensive risk assessment using collected data to evaluate the bank's exposure to climate risks. Analyze trends, correlations and vulnerabilities in operations, investments and lending practices, considering geographic locations, client portfolios and sectors.

Weighting and scoring

Assign weights to climate risk metrics based on significance and potential impact. Develop a scoring system to quantify risk levels. Apply weights to calculate an overall climate risk score for the bank.

Reporting and disclosure

Prepare reports outlining the bank's climate risk scores, key metrics, and mitigation strategies. Use frameworks like TCFD for transparency. Communicate scores and information to stakeholders, including regulators, investors, and customers.

ESG scoring methodologies

There are several ESG climate risk scoring methodologies used by various organizations and financial institutions. Here are a few of the most known:

CDP climate change scores

CDP (formerly the Carbon Disclosure Project) is an organization that assesses companies' environmental impacts. Their climate change scores evaluate companies' disclosure of climate-related data, their strategies for managing climate risks and their initiatives to reduce carbon emissions.

TCFD recommendations

The TCFD has developed a framework to help companies disclose climate-related risks and opportunities. While not a scoring methodology itself, many organizations use the TCFD recommendations as a basis for assessing climate risk.

Sustainalytics' carbon risk rating

Sustainalytics offers a carbon risk rating that evaluates companies’ exposure to climate-related risks and opportunities. It assesses factors like carbon emissions intensity, energy mix, climate governance and climate risk management.

MSCI ESG ratings

MSCI methodology assesses companies based on various climate-related criteria, such as greenhouse gas emissions, exposure to climate risks, energy efficiency and renewable energy investments.

FTSE (Financial Times Stock Exchange) Russell ESG ratings

FTSE Russell provides ESG ratings for companies. Their methodology includes climate change as one of the key themes and considers factors such as carbon emissions, climate-related disclosures, and climate risk management practices.

SASB (Sustainability Accounting Standards Board) Materiality Map

The SASB offers a Materiality Map that helps investors identify financially material sustainability issues, including climate-related risks. It provides guidance on which ESG factors are likely to be material for different industries.

Comparative analysis of the scoring models

The below table provides a summary of each methodology's main aspects, but there may be more detailed elements and considerations within each framework. Information availability and criteria may change over time and different methodologies may have varying criteria like weightings and scoring approaches. New methodologies are also continually evolving as our understanding of (and the available data on)climate risks improve.

| Aspect | MSCI ESG Ratings | Sustainanalytics’ Carbon Risk Rating | CDP Climate Change Scores | FTSE Russell ESG Ratings | SASB Materiality Map | TCFD Recommendations |

|---|---|---|---|---|---|---|

| Scope | Evaluates ESG performance across industries | Evaluates carbon-related risks and opportunities | Focuses on climate change mitigation and adaptation | Focuses on climate change mitigation and adaptation | Focuses on climate change mitigation and adaptation | Focuses on climate change mitigation and adaptation |

| Weighting and scoring | Proprietary model with weighted average score | Proprietary model considering carbon risk exposure, management and innovation | Scoring based on comprehensiveness, transparency and effectiveness | Proprietary model with weighted average score | Materiality determination based on industry-specific factors | Not a scoring methodology, but provides disclosure recommendations |

| Transparency | Detailed methodology publicly available | Methodology details available upon request | Methodology details provided, subject to change | Methodology details publicly available | Methodology details publicly available | Methodology details publicly available |

| Focus | Broad assessment of various ESG factors | Focus on carbon-related risks and opportunities | Specific focus on climate change-related factors | Broad assessment of various ESG factors | Financially material issues are covered | Focus on climate-related financial disclosures |

Mitigation and strategy development

Addressing climate risk requires a comprehensive and well-conceived strategy.

Organizations can follow the steps below to ease their transition to a sustainable future.

- Develop a comprehensive climate risk mitigation strategy based on the assessment results. This may involve reducing carbon emissions, improving energy efficiency, diversifying investments, and engaging with clients on sustainable practices.

- Continuously monitor and update climate risk scores as new data becomes available and as an organization’s exposure to climate risks changes.

- Implement risk management measures to address vulnerabilities and enhance resilience to climate risks.

- Collaborate with external specialists or consulting firms to ensure the accuracy and effectiveness of the climate risk scoring model, aligning it with industry best practices and regulatory requirements for credibility and transparency.

Conclusion

It has become imperative for businesses to manage climate risk and sustainable financing. Through proactive steps such as risk assessment, enhanced disclosure, sustainable investment practices and collaboration, organizations can not only manage climate risks effectively but also contribute to a more resilient and sustainable future. Businesses need to develop comprehensive strategies, and continuously monitor and update their approach. They need to collaborate with external experts to ensure credibility and transparency in tackling climate risks and progress toward achieving sustainability goals for the future.