How HCLTech’s AI-led platforms empower US healthcare payers to adapt, thrive and lead through policy disruptions.

July 2025 marked a pivotal moment in American healthcare policy with the passage of the One Big Beautiful Bill Act (OBBBA), a sweeping $2.5 trillion reconciliation package with significant ramifications for healthcare payers and the broader care ecosystem. While headlines emphasized tax cuts and immigration reform, the bill's deep structural changes to Medicaid, Affordable Care Act (ACA) marketplaces and healthcare subsidies are poised to reshape healthcare payers operations, risk models, member engagement strategies and profitability for years to come.

This blog examines the bill's most critical healthcare provisions, analyzes their impact on healthcare payers and offers business and AI led technical strategies to navigate the new landscape.

Key provisions affecting healthcare payers

The OBBBA introduces several provisions that directly reshape the structure, accessibility and affordability of healthcare payers. Below is an overview of the significant changes that are impacting healthcare payers.

Medicaid reforms

Work and reporting requirements:

Beginning in 2027, Medicaid enrollees in the 40 states and Washington, D.C., that adopted ACA expansion will be required to demonstrate that they are working, volunteering or attending school for at least 80 hours per month, unless exempt (e.g., for caregiving or disability). Additionally, states must conduct eligibility checks every six months, increasing the risk of midyear coverage loss.

Out-of-pocket costs:

Enrollees with incomes between the federal poverty level ($15,650 for an individual in 2025) and 138% of that income level ($21,597) will be required to pay co-pays of up to $35 for certain services, such as lab tests or doctor visits, with a cap at 5% of annual income.

Provider tax reductions:

The legislation caps and gradually reduces state-levied provider taxes, which states use to draw federal Medicaid matching funds.

ACA marketplace changes

Expiration of enhanced subsidies: The enhanced premium tax credits, enacted through the American Rescue Plan Act (ARPA) and extended by the Inflation Reduction Act (IRA), will expire at the end of 2025. These subsidies reduced premiums by an average of $705 annually and expanded eligibility to those earning above 400% of the poverty level. Their expiration is expected to increase premiums by 75% on average, leading to significant coverage losses.

Shortened open enrollment period: The ACA Marketplace open enrollment period is reduced from November 1 to January 15 to November 1 to December 15, potentially limiting enrollment opportunities.

Pre-Enrollment verification: The OBBBA mandates real-time verification of income, immigration status and other eligibility criteria before subsidies are granted, delaying access to affordable premiums. Enrollees can currently access subsidized plans immediately with eligibility verified within 90 days.

End of automatic re-enrollment: In 2025, over 10 million people automatically re-enrolled in ACA plans. The OBBBA eliminates this feature starting in 2028, requiring annual updates to income and other data that may increase administrative burdens and coverage lapses.

Quantifying the impact on healthcare payers

The CBO provides critical estimates on the OBBBA’s effects, offering a data-driven perspective for healthcare payer leaders:

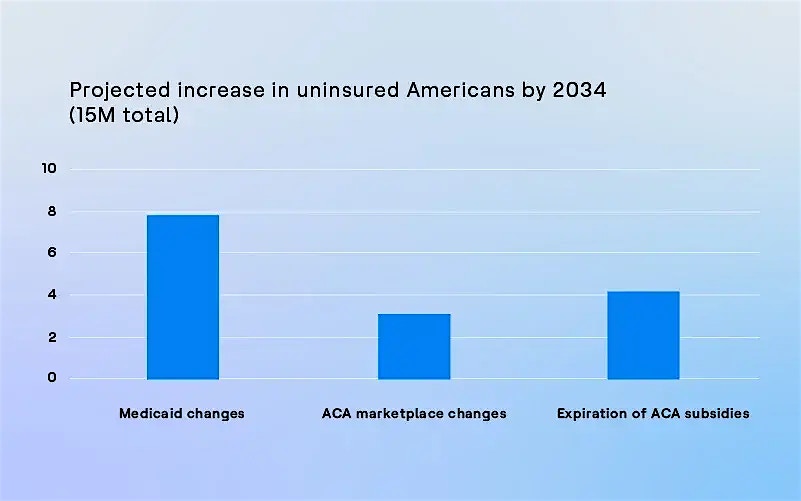

Increase in uninsured Americans by 2034

The OBBBA is poised to significantly impact insurance coverage, with projections indicating an increase of 15 million uninsured Americans by 2034.

- Medicaid changes: Approximately 7.8 million individuals may lose coverage due to new work requirements, eligibility checks and co-pay structures, making Medicaid the single largest contributor to the uninsured population.

- ACA marketplace changes: An estimated 3.1 million individuals could be affected due to subsidy restrictions and enrollment barriers, further straining access to affordable healthcare payers.

- Expiration of ACA subsidies: The expiration of enhanced premium tax credits is expected to result in 4.1 million additional uninsured individuals, exacerbating coverage gaps.

This data, derived from the Congressional Budget Office (CBO) estimates, underscores the urgent need for healthcare payers to adapt their strategies to mitigate these losses and support affected populations. The chart visually highlights the disproportionate impact of Medicaid reforms, signaling a critical area for targeted interventions.

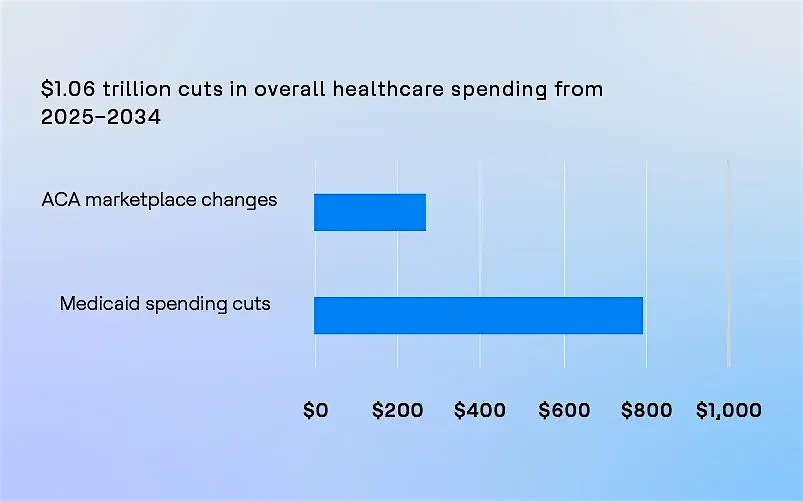

Overall healthcare spending from 2025 to 2034

The OBBBA introduces significant reductions in healthcare spending, totaling an estimated $1.06 trillion over the decade from 2025 to 2034.

- Medicaid spending cuts: Accounting for the lion’s share at $793 billion, these reductions stem from work requirements, eligibility restrictions and limits on provider taxes, reflecting a major overhaul of the program.

- ACA marketplace changes: Contributing $268 billion, these cuts arise from the expiration of enhanced subsidies and stricter enrollment policies, impacting the affordability and accessibility of marketplace plans.

This data, based on Congressional Budget Office (CBO) projections, highlights the substantial financial restructuring within the healthcare sector. The chart underscores the disproportionate burden on Medicaid, signaling a critical focus area for health plan leaders to address as they navigate the fiscal and operational implications of the OBBBA.

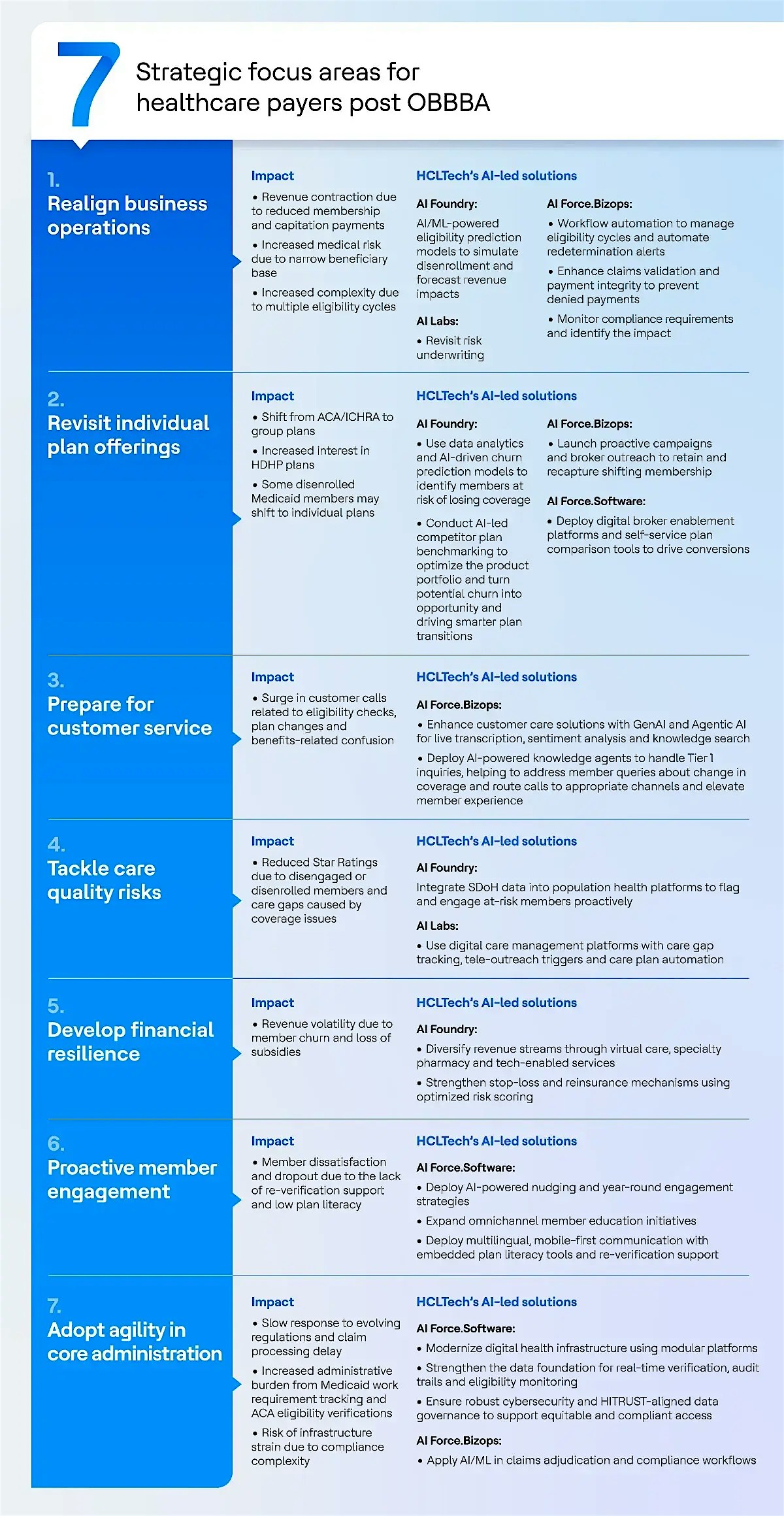

Transforming post-OBBBA operations: HCLTech's AI-driven solutions for healthcare payers

The passage of the OBBBA in 2025 marks a transformative shift in the US healthcare landscape, with sweeping policy changes that directly impact healthcare payers' business models, risk pools and operational resilience. Technology is critical in mitigating the risks of managing operational complexity and retaining memberships. Despite near-term pressures on financials and membership volumes, healthcare payers must continue to invest in technology as a core enabler of long-term sustainability and competitiveness. Delaying or scaling back digital transformation initiatives in response to current headwinds may risk undermining operational agility, member trust and regulatory readiness.

HCLTech’s AI-led solutions—AI Force, AI Foundry and AI Labs can empower healthcare payers to navigate the challenges of the OBBBA. AI Force is HCLTech’s flagship platform, offering AI-driven service transformation across software engineering, business processes and IT operations. AI Foundry provides a scalable framework for accelerating AI adoption, modernizing data and enabling vertical AI solutions for the healthcare industry. Lastly, AI Labs serves as a collaborative space for rapid prototyping, innovationand experimentation, helping healthcare payers develop and implement AI strategies that drive real-world impact.

The following table outlines the key business operations impacted by OBBBA and the corresponding AI-led solutions that HCLTech provides to mitigate these challenges.

Conclusion

The One Big Beautiful Bill Act introduces structural shifts that compel healthcare payers to transition from reactive adjustments to proactive business and technology transformation across operations, products and member engagement. By leveraging HCLTech’s AI Force, AI Foundry and AI Labs, healthcare payers can embrace a tech-first approach to navigating the complexities introduced by OBBBA. These AI-led solutions not only streamline operations and enhance member engagement but also foster long-term resilience in a rapidly evolving market. The path forward lies in data-driven decision-making, intelligent automation and member-first innovation. Those who act decisively will not only mitigate disruption but also emerge as frontrunners in a reshaped healthcare economy.

References:

- Allocating CBO’s Estimates of Federal Medicaid Spending Reductions and Enrollment Loss Across the States: House Reconciliation Bill | KFF

- Preliminary Analysis of the Distributional Effects of the One Big Beautiful Bill Act

- How Trump's tax bill will affect Medicaid, ACA plans and hospitals : Shots - Health News : NPR